Patents for 3D secure transactions nearly double in 2023

Payment entities are looking to strengthen their security to combat online threats.

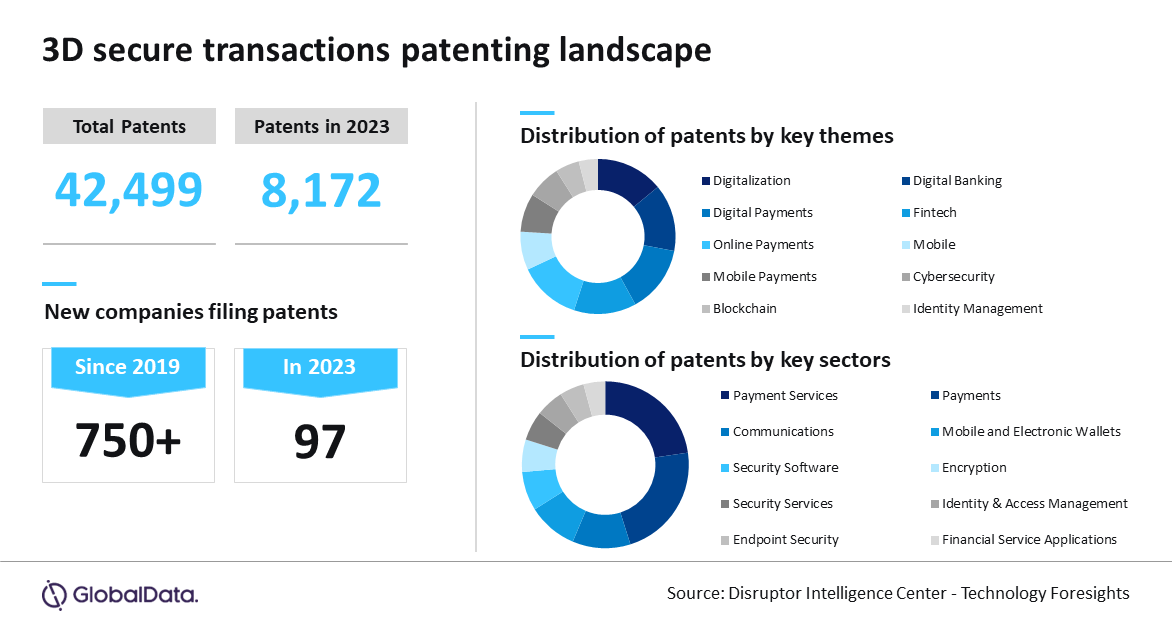

The patent filings for 3D secure transactions almost doubled in 2023 as the banking industry strengthens security to combat the rise of online threats.

A total of 8,172 patent filings for secure transactions were recorded in 2023, compared to just 4,603 filings in 2022, according to a report by data and analytics company GlobalData.

3D secure technology is an authentication framework that prevents fraud whilst ensuring a ‘seamless’ user experience. It authenticates online payments through three domains: the issuer (card-issuing bank), the acquirer (merchant’s bank), and the interoperability domain (secure communication infrastructure).

The growth in patent filings underscores the sector’s commitment to embedding advanced authentication measures across digital channels, driven by the rising frequency of online fraud and heightened customer expectations for seamless security, said GlobalData.

Rahul Kumar Singh, Senior Analyst of Disruptive Tech at GlobalData, comments: “By integrating advanced, multi-layered security measures, banks are not only responding to the emerging threats but also refining authentication to balance protection with seamless user experiences,” said Rahul Kumar Singh, senior analyst of disruptive tech, GlobalData.

Amongst developments included one by Visa, wherein they developed mobile tokenization hubs and NFC-enabled virtual wallets to enhance the security and convenience of contactless payments.

Mastercard has also utilized blockchain-based credential management systems to reinforce mobile payment integrity.

Capital One Financial Corp., meanwhile, created gesture-activated and voice-protected cards.

Advertise

Advertise