Digital wallet transactions scale easily via cloud environments

Digital wallets are driving demand for scalable payment solutions.

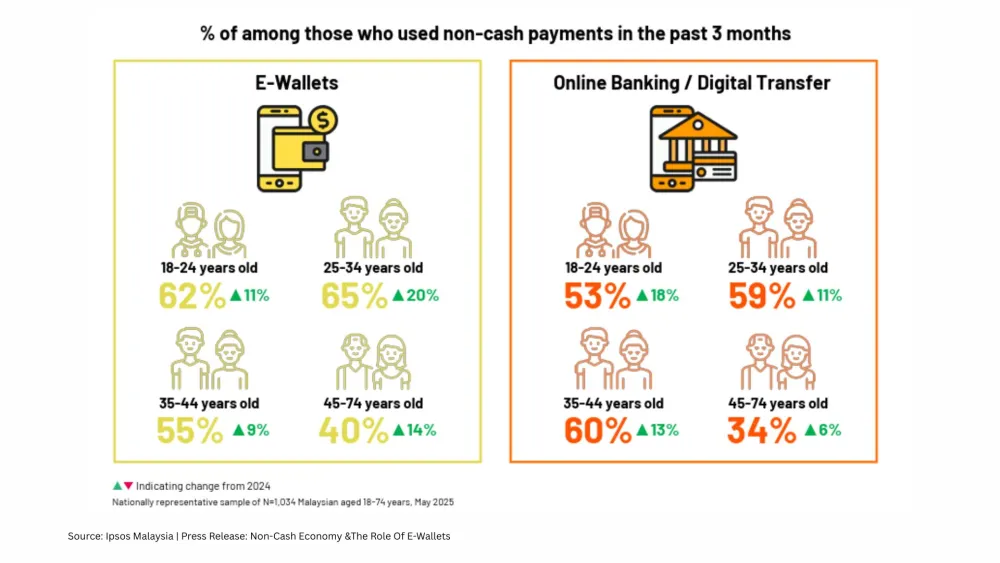

As digital wallets account for 50% of all e-commerce purchases, businesses must adapt their payment infrastructure to meet growing demand. Daryn Griggs, Managing Director of APAC at Episode Six, emphasised the importance of scalable and flexible solutions in addressing diverse market needs.

“Digital wallets can be funded by multiple sources,” Griggs explained. “Most are funded by card products sitting in the backend, while others are funded by bank accounts, cash, or other means.”

He said that card-funded digital wallets dominate the e-commerce landscape, while for bank-powered e-wallets operating in closed-loop environments, scalability remains critical. “A lot of these wallets run on a bank’s infrastructure and are typically cloud-based, allowing them to scale very easily,” Griggs noted.

Consumers prioritise ease of use, speed, and security in payment systems. “They want transactions to be fast and seamless, especially for e-commerce,” said Griggs. Security remains a top priority, with consumers expecting safe and reliable transactions.

“Older systems are expensive and time-consuming to change,” Griggs observed. To stay competitive, businesses must innovate, deploy updates quickly, and adapt to constant regulatory changes.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership