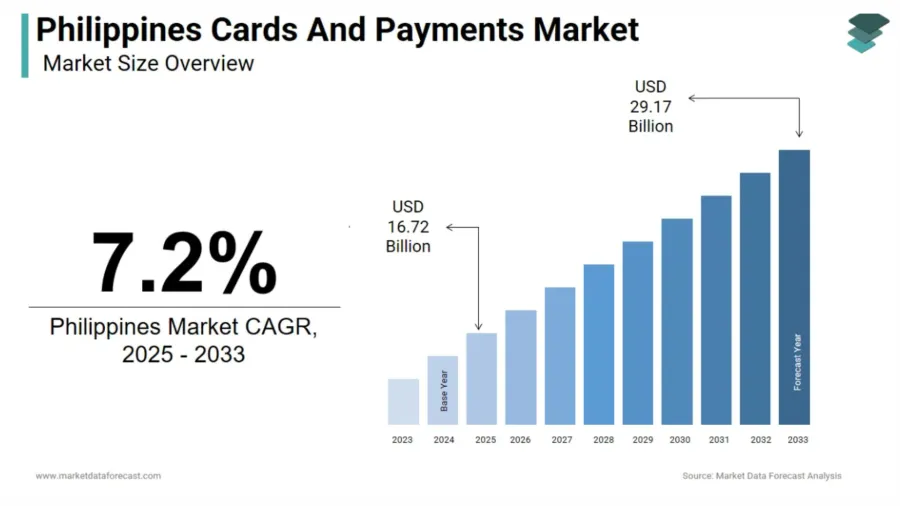

Philippine payments market to hit $29.17b by 2033

The report places 2025 value at $16.72b and tracks a climb from 2024 baseline levels.

The Philippine cards and payments market was valued at $15.60b in 2024 and is expected to grow at a compound annual rate of 7.2% from 2025 to 2033.

The market is projected to reach $29.17b by 2033, up from $16.72b in 2025, according to a report by Market Data Forecast.

Growth is being driven by the rapid expansion of digital financial inclusion, supported by higher internet penetration and increased smartphone use.

Government initiatives under the National Retail Payment System, along with mobile money platforms such as GCash and Maya, have brought millions of previously unbanked Filipinos into the formal financial system.

Consumer payment habits are also shifting. Data from Mastercard showed that contactless card usage rose 45% year on year in 2023, reflecting growing demand for faster and more secure payment options, particularly in urban areas such as Metro Manila and Cebu.

Government efforts to promote cashless transactions have further supported market growth.

The rollout of QR Ph, the country’s standardised QR code payment system, has improved interoperability between banks and fintech firms.

As of December 2023, more than 800,000 merchants nationwide accepted QR Ph payments, according to the Payments and Settlements System Monitor.

Digital payments have also been integrated into public services, including transport, tax payments, and healthcare, helping to reduce reliance on cash and increase everyday use of electronic payments across the country.

Advertise

Advertise