Chart of the Week: 1 in 3 online transaction in Australia use alt payments

The e-commerce market will be worth $51b in 2023, according to GlobalData.

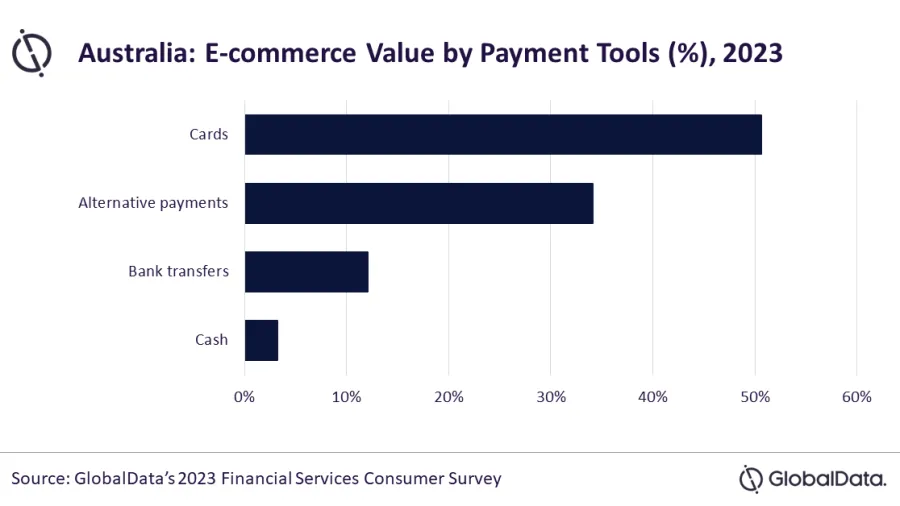

Alternative payment methods– such as mobile and digital wallets– are growing in popularity as the preferred mode of payment by online shoppers and are set to account for 1 in every 3 or 34.1% of payments made on online shopping platforms in 2023, according to GlobalData.

Australia’s e-commerce market is increasingly becoming a major battleground for payments providers, with the market expected to be worth $51b (A$74.9b) in 2023, a 10.3% growth.

The popularity of online shopping events such as Black Friday, Cyber Monday, and Afterpay Day has helped drive e-commerce growth in the country, noted Shivani Gupta, Senior Analyst Banking and Payments at GlobalData.

“E-commerce payments in Australia are dominated by payment cards, accounting for a 50.6% share in e-commerce payment value in 2023. Of this, credit and charge cards account for 29.2% share while debit cards account for 20.9%, according to the GlobalData’s 2023 Financial Services Consumer Survey,” Gupta noted.

The market is set to increase at a compound annual growth rate (CAGR) of 7.5% between 2023 and 2027 to reach AUD99.8 billion ($68.0 billion) in 2027.

Consumers prefer credit and charge cards due to the value-added benefits they offer including interest free installment payment options, reward programs, cashback, and discounts.

ALSO READ: Thai regulator warns of weakening debt serviceability, bond market

The growth of alternative payments has also been driven by the rising popularity of buy now, pay later (BNPL) solutions. Some of the prominent BNPL brands in Australia are Afterpay, Zip, and Klarna.

Advertise

Advertise