Chart of the Week: 8 in 10 Chinese people use mobile wallets

Alipay and WeChat pay each have 1 billion users globally.

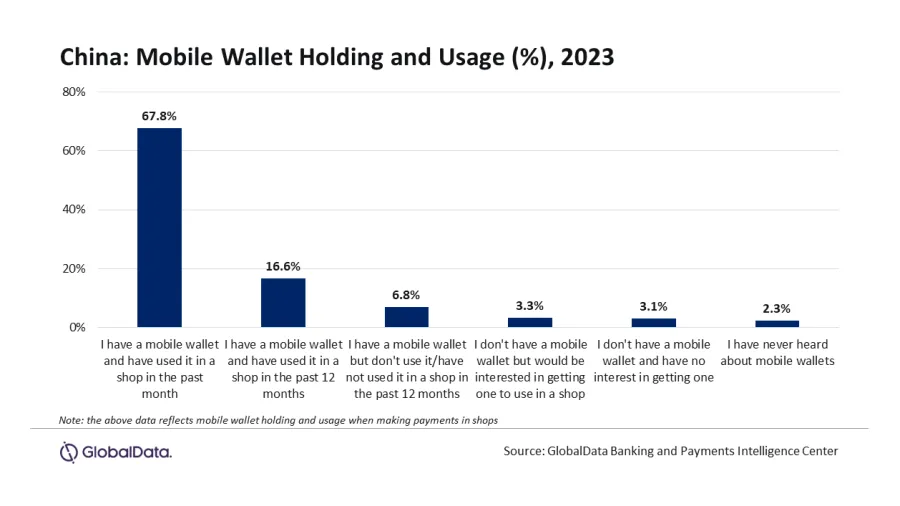

Over 8 in 10 (84%) of people in China use mobile wallets, reports data and analytics firm GlobalData, based on its latest Financial Services Consumer Survey.

Approximately 84.4% of survey respondents from China indicated that they have a mobile wallet and have used it in a shop in the past 12 months.

Outside of China, Asian markets are reportedly spearheading the adoption of mobile wallets, with 8 amongst the top 10 markets with high mobile wallet adoption hailing from the continent, GlobalData said in its study, which surveyed 50,000 individuals aged 18 and above across 40 countries.

“The availability of low-cost smartphones and high-speed internet provided the necessary digital infrastructure for the growth of mobile wallets,” said Poornima Chinta, senior banking and payments analyst at GlobalData.

ALSO READ: Chinese banks’ net profits down 0.81% in Q1

The consumer preference for domestic mobile wallet brands including Alipay and WeChat Pay is also significantly contributing to this growth, Chinta said.

Alipay and WeChat Pay now have more than 1 billion users globally and dominate the mobile payment market in China. Notably, WeChat Pay’s widespread adoption was thanks to its integration in the popular instant messaging and social media platform WeChat.

International brands such as Apple Pay and Samsung Pay are also reportedly making their presence.

Government push has also accelerated adoption. China’s central bank is reportedly working on a unified QR code for its digital currency e-CNY, which GlobalData expects to further drive interoperability and growth of mobile wallets.

“The Chinese mobile wallet market is poised for further expansion over the next few years. This will be driven by the government initiatives, a sizable tech-savvy population, the rising acceptance of QR code-based payments among merchants, and a growing preference for cashless payment methods,” Chinta concluded.

Advertise

Advertise