Chart of the Week: APAC eats up global payments pie but lags in electronification

The region's e-payment transactions are up to 65% lower than Europe's.

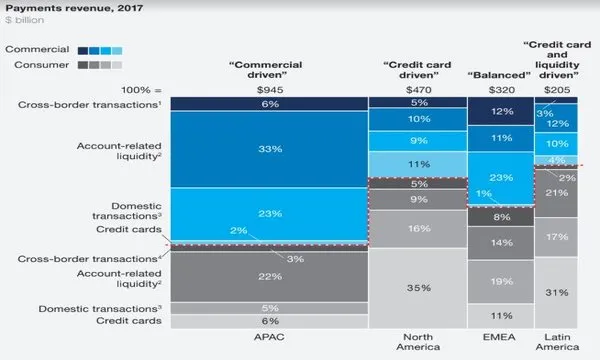

Even as the Asia-Pacific already generated a whopping $900b in payment revenue in 2017, the region's growth prospects is still expected to outpace that of its peers on the back of steady expansion in liquidity, according to management consultancy firm McKinsey.

"Remarkably, double-digit growth (20%) has continued even as the base of business has grown," the firm said in a report launched at Sibos 2018. "Although our forecast calls for inevitable moderation, revenues in the region should continue to grow at low double-digit rates over the next five years, still considerably faster than any other region."

Also read: E-payment transactions in South Korea hit 10-year high in Q2

Revenues from the 'credit card and liquidity driven' payments sector in Latin America is expected to trail behind APAC at second place with an average annual growth of 8% over the next five years as Brazil's payment sector takes hit from stringent regulatory action on credit card rates.

EMEA revenues are expected to remain flat as they have been for the past ten years although they might witness revenue growth in mid-single digits in 2022 as rate environment stabilises.

Also read: Asia beats Europe in developing new payments technologies

North America's 'credit card driven' region, on the other hand, is expected to bounce back to maintain healthy single-digit growth over a five year horizon.

Despite the double-digit growth forecast, APAC still lags behind other regions in overall electronification of payments at 21% with the share of e-payment transactions in the region as much as 65% lower than that in Europe and North America.

"In other words, payments are significantly costlier for the economy in Asia-Pacific and Latin America, because the cost of processing cash and check payments is higher, as are the fees paid by consumers and businesses," added McKinsey.

Nonetheless, the region is making good headway to move away from cash with electronification levels more than doubling since 2012, led by China whose e-payments share has increased more than ten-fold over the past five years from 4% in 2012 to 34% in 2017

Advertise

Advertise