Chart of the Week: Malaysia’s card payments market to be worth $80.2b in 2025

Market value is expected to rebound 8.5% in 2020 after declining last year.

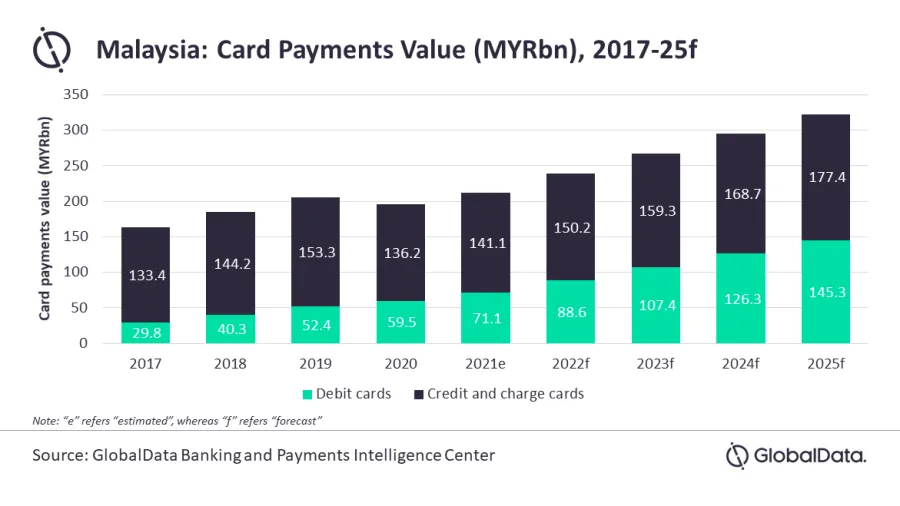

The Malaysian card payments market is set to rebound in 2021 and reach $80.2b (MYR322.7b) in 2025, reported GlobalData, adata and analytics company.

The value of card payments in the country declined 4.9% in 2020 due to the pandemic. Lockdowns and social distancing restrictions reduced consumer spending and led to the closure of brick-and-mortar shops, which affected card payments, GlobalData said.

With improving economic conditions and the vaccination program gathering pace, card payment is estimated to rebound strongly and rise by 8.5% in 2021, said Ravi Sahrma, lead banking and payments analyst at GlobalData.

“Malaysia made significant progress in the adoption of card payments in the past few years supported by an increasing banked population, rising consumer awareness of electronic payments, and increasing merchant acceptance,” Sharma said. “Whilst the market was affected due to the COVID-19 pandemic in 2020, it is expected to rebound as consumers shift from cash to non-cash payments to avoid getting infected.”

Overall GlobalData forecasts the value of card payments to grow at a compound annual growth rate of 11.1% over the next four years.

Credit and charge cards remain the most preferred card type for payments in Malaysia thanks to their reward benefits. They account for 66.5% of all card payments by value in 2021.

Debit cards account for the remaining 33.5% share, and registered a growth of 13.6% in 2020 on the back of the migration of cash transactions to debit cards and growing preference of debit cards for contactless payments.

Credit and charge cards, on the other hand, whilst remaining the biggest, registered a decline of 11.2% in 2020 as lockdown and travel restrictions affecting spending.

The rise in contactless is an important factor supporting card payments growth in Malaysia, GlobalData noted. According to the Central Bank of Malaysia, contactless card transactions accounted for 50% of all card payments in 2020, a jump from only 33% in 2019.

Advertise

Advertise