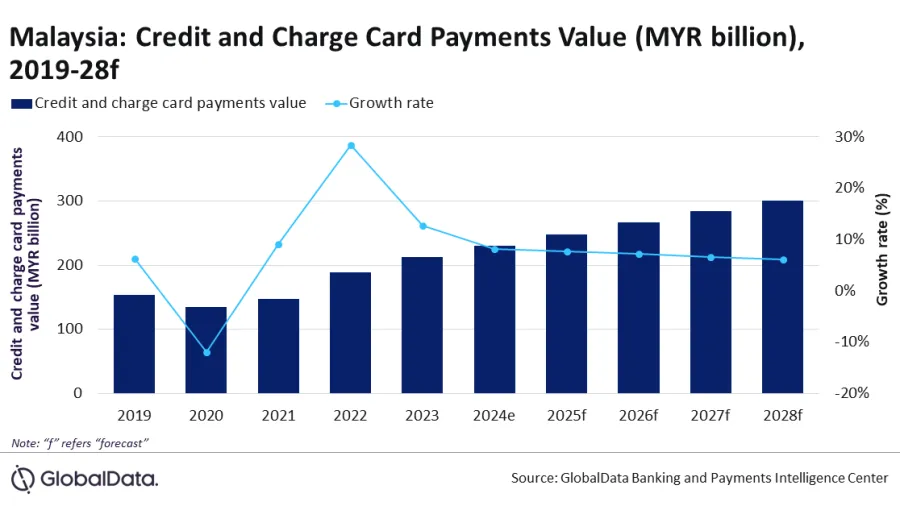

Malaysia’s credit, charge card market value grows to $50.5b in 2024

Credit and charge cards make up 60% of all card payments in the country.

Malaysia’s credit and charge card payment market is expected to be worth $50.5b (MYR230.5b) in 2024, a growth of 8.2%, reports data and analytics firm GlobalData.

Rising consumer spending will extend the market’s 12.7% growth in 2023. A developing payment infrastructure, a growing e-commerce market, and a rapid shift towards cashless payments are further driving the adoption and usage of credit and charge cards among Malaysians, GlobalData said.

This comes as credit and charge cards are now the most preferred card payment method in Malaysia, accounting for over 60% of total card payments by value, noted Poornima Chinta, leading banking and payments analyst at GlobalData.

ALSO READ: How banks should rethink pricing

“Malaysians are increasingly using credit and charge cards for payments, with the frequency of payments per card standing at 77.3 times in 2023, compared to 31.2 times for debit cards,” Chinta noted.

“The country’s developing payment infrastructure, rising consumer awareness, growing merchant acceptance, and value-added benefits associated with credit and charge cards are supporting this growth,” Chinta added.

Advertise

Advertise