Thailand’s credit and charge card payments to rise 7.1% to $65.6b in 2025

Benefits such as rewards points, discounts, and cashbacks helped push for its growth.

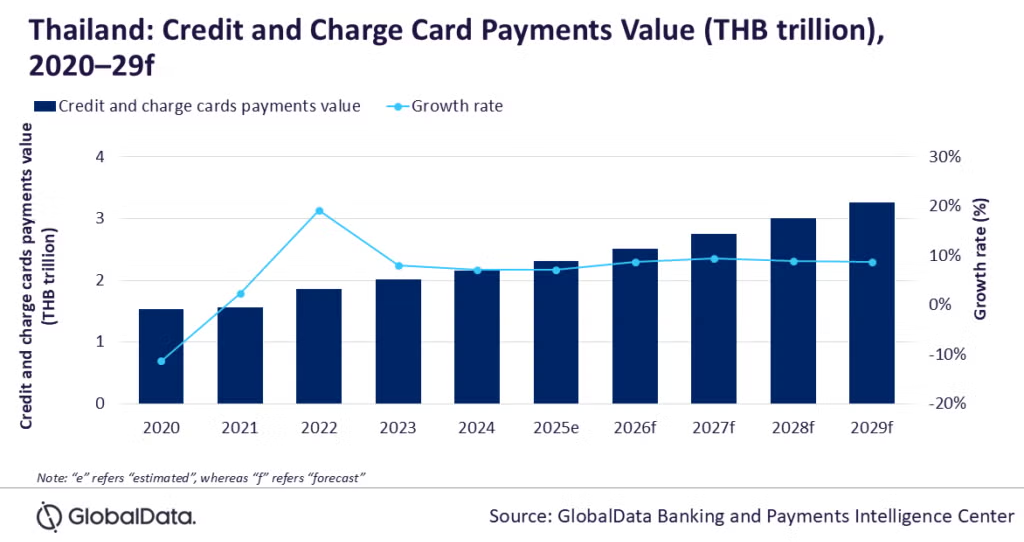

Thailand’s credit and charge card payments market is projected to rise by 7.1% to $65.6b (THB2.3t) in 2025, according to estimates by GlobalData.

Increasing adoption of digital payment solutions and shift in consumer behavior towards cashless transactions will drive the increase, the data and analytics firm said in an April 2025 report.

The market grew by 7.1% in 2024, driven by higher consumer spending.

Between 2025 and 2029, the compound annual growth rate (CAGR) is expected to be 9%, with the market likely being valued at $92.6b (THB3.3t) in 2029.

Benefits such as rewards points, discounts, flexible payment facilities, and cashbacks also pushed growth in the market.

The development of the POS infrastructure has also supported the rise of card use in Thailand. The number of POS terminals per million inhabitants in the country has increased to 13,507 in 2024 from 12,501 in 2020.

There is still significant room for expansion of the POS infrastructure, GlobalData said.

Advertise

Advertise