Bank of China Hong Kong

Bank of China (Hong Kong), abbreviated as BOCHK, is a subsidiary of the China-headquartered banking giant Bank of China.

The bank was formed in 2001, after the Bank of China Group in Hong Kong restructured and combined the businesses of 10 of the 12 banks it operates and owns in Hong Kong.

It is one of the three note-issuing banks and the sole clearing bank for Renminbi (“RMB”) business in Hong Kong.

BOCHK capitalisation strong but property risks remain

BOCHK capitalisation strong but property risks remain

Fee income and treasury income will support its profitability through mid-2027.

BOCHK partners with Manulife to launch multi-asset income solutions

It will draw on global income sources such as preferred securities and others.

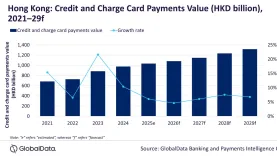

Chart of the Week: HK credit and charge card market to reach $132.4b

Banks are rolling out new services, such as a mobile virtual card and a dual-currency card.

Bank of China Hong Kong stays resilient with buffer against CRE risks

S&P anticipates moderately slower asset growth.

BOCHK reports 6.1% higher net operating profit for Q3

There were reportedly more business opportunities as tourism recovered.

BOCHK makes fully automated transactions of corporate remittances

BOCHK is the first Hong Kong commercial bank to connect to mBridge.

BOCHK warns against suspicious SMS messages

It reminded customers that it will only send messages starting with a “#”.

Top banks’ market cap up 5.4% in Q2

China’s big four banks saw growth although NIMs fell.

BOCHK to conduct system maintenance on 4 August

Some services will be unavailable until 12NN.

BOCHK warns against phishing website

The fake login page intends to steal customers’ data, BOCHK said.

BOCHK's strong profits combats its property loan weakness

The bad loans ratio, whilst rising in 2023, is expected to fall to 0.7% in 2024-2025.

BOCHK warns against phishing email

It advised customers to delete suspicious emails and attachments without opening them.

BOCHK warns against 4 fake websites

The sites purport to be from a logistics service provider and online trading platform.

BOCHK warns of fake websites

The websites reportedly intend to steal customers’ data.

BOCHK warns against fraudulent website

The bank denied any connection to the site and has reported it to authorities.

BOCHK warns of phishing emails

It has reported the case to Hong Kong authorities.

Bank of China HK uses e-CNY for $5.1m cross-boundary settlement

It's a stepping stone towards the normalization of e-CNY use amongst BOCHK's corporate customers.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership