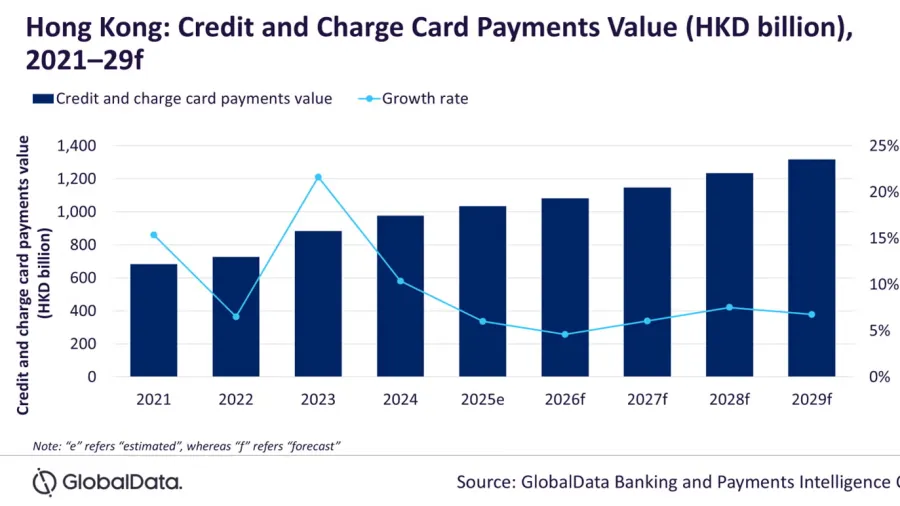

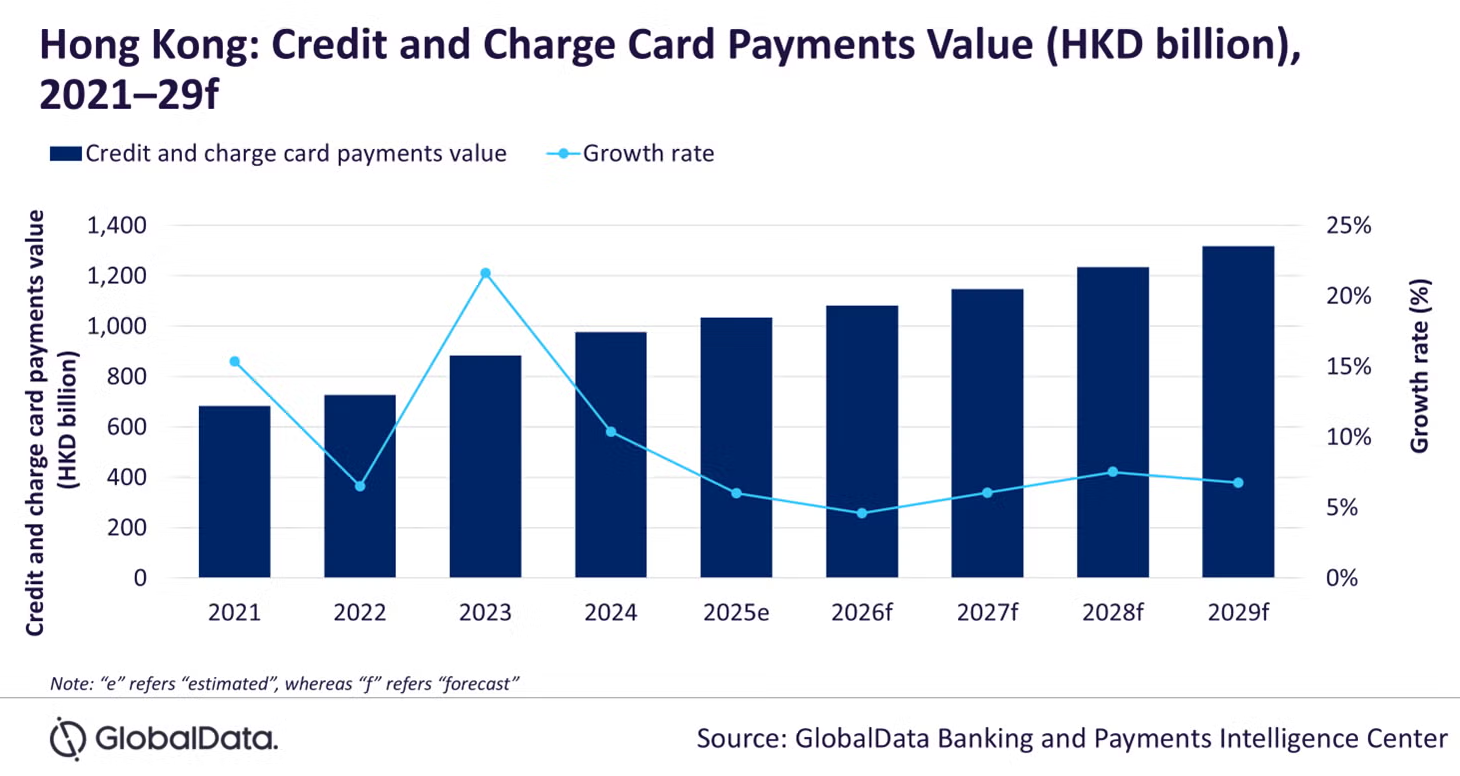

Chart of the Week: HK credit and charge card market to reach $132.4b

Banks are rolling out new services, such as a mobile virtual card and a dual-currency card.

Hong Kong’s credit and charge card payments market is expected to grow by 6% and reach $132.4b (HK$1t) in 2025, according to estimates by data and analytics company GlobalData.

In 2024, credit and charge cards made up 77% of all card payments in Hong Kong, with customers increasing their spending thanks to a developing payment infrastructure, growing merchant acceptants, and benefits offered.

There are 27,252 point-of-sale (POS) terminals per a million inhabitants in Hong Kong, higher than Japan, Thailand, and Indonesia.

Banks are also encouraging adoption through the introduction of various new schemes.

In June 2025, HSBC and Mastercard rolled out the city’s first mobile virtual corporate card for commercial customers.

Businesses can instantly issue virtual cards through the virtual card portal. Users can also add them to compatible digital wallets for immediate use via the Mastercard In Control Pay mobile app. The virtual cards can be activated or deactivated anytime and anywhere.

In the same month, the Bank of China Hong Kong (BOCHK) teamed up with UnionPay International to launch a dual-currency BOC Go credit card. This enables card holders to make purchases in Chinese yuan and Hong Kong Dollar.

In Q1 2025, the total value of credit card transactions in Hong Kong rose 8.4% year-on-year (YoY) to $34.9b (HK$274.1b), according to data from the Hong Kong Monetary Authority (HKMA).

Of that value, $23.7b (HK$186.1b) was related to retail spending in Hong Kong, $10.06b (HK$79b) was on overseas retail spending, and $1.15b (HK$9b) were cash advances.

To manage the risk, banks are providing flexible repayment periods for credit card users. For instance, Citibank offers the Merchant Instalment Plan, which allows credit card holders to convert purchases of HKD2,000 ($256) or above at over 600 participating merchants into monthly installments.

Standard Chartered customers can convert purchases of HKD500 ($64) and above into three- to 60 monthly installments.

Advertise

Advertise