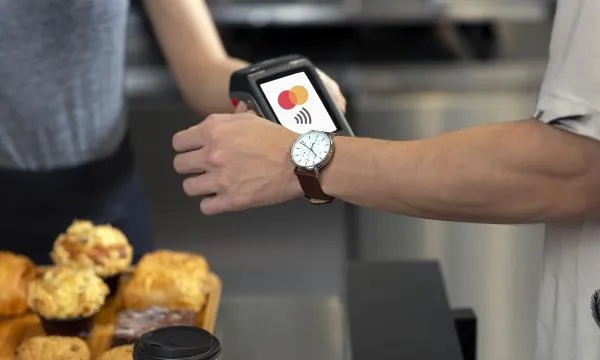

Coronavirus triggers switch to contactless payments in APAC

Health concerns made contactless payments more favourable to consumers.

Health and cleanliness concerns brought by the coronavirus pandemic is spurring a move to contactless payments, with 51% in Asia Pacific making the switch since the crisis began, a Mastercard consumer poll revealed.

Hygiene appears to be the primary reason, with 51% saying that they wipe their cards clean after every use. Four-fifths (80%) view contactless as the cleaner way to pay, whilst 70% said it is safer.

Almost three-fourths (74%) of respondents expressed concern about the health impacts of touching a pen or keypad at the point of sale. More than half (68%) said they prefer to shop at stores which provide contactless options.

Forty-six percent said they have been going cashless often since the crisis began.

The region also shows a high level of intended cashless use in the future. Seventy-two percent said contactless is now their preferred method of payment, especially in Singapore (76%) and Australia (67%).

Three-fifths (75%) intend to use tap-and-go methods even after the pandemic is over. Specifically, the number is particularly high amongst millennials (83%), those particularly concerned about the virus (78%), Singaporeans (77%), Gen Z (74%), and Australians (73%).

Advertise

Advertise