Fintech investments into China hit $60.1b in 2014-Q1 2019

Payment and remittances companies snapped up $24.7b in funding.

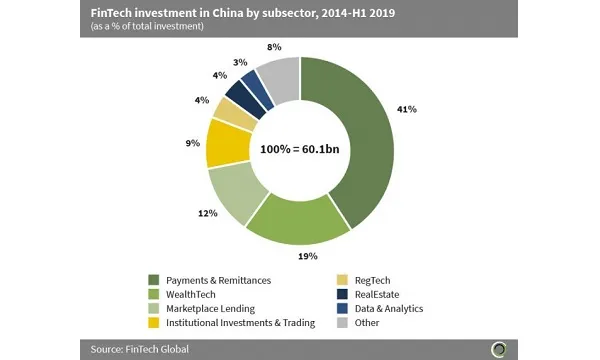

Fintech investments in China has reached a whopping $60.1b in 2014-Q1 2019 amidst massive capital injections scored by startups in the payments and remittances verticals, according to a report by FinTech Global.

Nearly half or 41% or a $24.7b of the total capital has involved companies in the payments and remittances subsector. The largest deal of the period went to Ant Financial in a Series C round of $14b.

Also read: Chinese banks thrive on mobile payments as millennials drive cashless push

Chinese WealthTech companies also captured a healthy proportion of total investment during this period, with 19% of funding going to this subsector. Meanwhile, Marketplace Lending, and Institutional Investments and Trading companies captured 12% and 9% of the total investments, respectively.

Also read: Singapore fintech funding nearly quadrupled to US$453m in first six months of 2019

The top 10 deals over the period collectively raised $34.4b, equal to 57.2% of the total capital invested during the period. The payments and remittances sector accounted for the top three deals, all of which involved investments to unicorn firm Ant Financial.

In particular, Ant Financial’s $14b series C round was the largest deal of the period. The online payment services provider will reportedly use the funding for technological development, as well as to cultivate tech talent in emerging markets and to accelerate the globalisation of its payment service AliPay. Following the completion of this deal, the company is now valued at $150b, well above both Morgan Stanley ($66.0b) and Goldman Sachs ($72.0b) combined.

Other subsectors present in the top ten involved deals related to WealthTech as well as Institutional Investments and Trading.

Meanwhile, the largest deal of the period after Ant Financial came from Du Xiaoman Financial’s $2.9b debt financing round in Q4 2018 lead by the Bank of Tianjin. The company provides money management services, risk management, data analysis and econometric models analysis and plans to use the capital for educational instalment and other scenario consumptions.

Advertise

Advertise