Will Singapore banks' digital home loans rattle incumbent proptechs?

OCBC has already scored $200m worth of home loans from its digital solution.

When OCBC Bank launched its homebuying-slash-ownership platform called OneAdvisor in January 2018, it said it aimed to address services that do not “paint the full picture” of home buying for consumers. It currently has “affordability” advice which calculates price as well as down-payment and stamp duty amongst others, property listings, and explanations for regulatory rules for homes.

Notably, OCBC had secured $200m of home loans through OneAdvisor alongside its chatbot for home and renovation loans called Emma (launched January last year) OCBC Bank’s head of consumer secured lending Phang Lah Hwa revealed. “OCBC OneAdvisor saw traffic of more than 110,000 from 53,000 unique visitors. These visits resulted in over 1,200 leads alone from OneAdvisor,” she added.

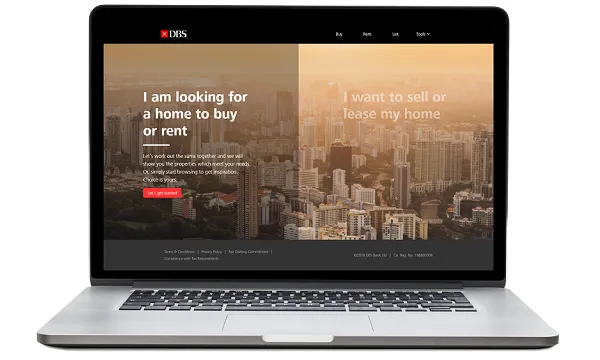

OCBC is not the only bank to wet its toes in the growing puddle of proptech, but it got in the game earlier than DBS and UOB. DBS had launched in July a property marketplace featuring listings from both agents and owners through a partnership with listing platforms EdgeProp and Averspace.

The site also has a financial planner that also helps first-time buyers determine their affordability price range based on CPF and cash deposits, facilitate paperless transactions, and get in touch with service providers for utilities, digital home solutions, and even cleaning and moving services.

On the other hand, UOB announced early-August that it has teamed up with four property agencies ERA Realty, Huttons Asia, OrangeTee & Tie, and PropNex Realty, as well as online proptech firm SoReal Prop to launch a fully-digital home loan solution. Services under UOB’s solution include Singapore's first bank-backed property valuation tool, a banker and buyer matching service called GetBanker, and an online instant home loan approval service.

“As UOB finances more than 30% of all new property sales in Singapore, we understood first-hand from our property partners and homebuyers that they wanted certainty and simplicity in property transactions,” said Jacquelyn Tan, UOB’s head of financial personal services in Singapore.

A threat to proptech start-ups?

With these big banks’ slow but giant strides towards proptech, should proptech firms feel threatened? After all, the landscape in both Singapore and the Asia Pacific is still filled with budding start-ups. JLL revealed that in the region, 179 proptech start-ups raised US$4.8b — more than half of the world’s total of US$7.8b — from 2013 to June 2017.

Keff Hui, a broker from Mortgage Supermart, believes the impact should be minimal. “Proptech is the fusion of property and technology while home loans are complements of it. On property standalone, the purchasing considerations of buying a property is multifaceted and offers plenty of opportunities for tech solutions to enhance and bridge the gap,” he said.

“A fully digital home loan platform could help it to streamline processes, reduce manpower cost, improve processing turnaround and possibly avoid and reduce some competition whilst offering consumers an alternative additional application channel for the banks,” Hui added.

A slightly different viewpoint came from Michael Cho, founder of proptech start-up UrbanZoom, who thinks banks’ initiatives are great news for consumers. “This isn't just merely a case of tech being used as an enabler, this to me signals a real mind shift of well-resourced financial institutions willing to embrace innovations and the risks that come with product experimentations,” he said.

UrbanZoom focuses on predicting the price of a home in a certain time period, called a ZoomValue, by having its AI algorithms analyse data points. Its platform also shows owners the sales listings nearby as well as past transactions and comparisons with other blocks.

Moreover, Cho said that young start-ups like them are not likely to fail because of competition but because of a failure to execute. “So, in that sense, I don't feel ‘threatened’; if anything I actually think that they could be great partners to us as they show an increasing appetite to adopt cutting-edge technology, which is a core focus for us at UrbanZoom."

What do proptech firms have that banks don’t have?

Moreover, proptech firms said they have a competitive edge over banks trying to get into the technology. For Hui, banks could be limited by regulations as well as proptech firms’ dimension and scope of the range of services and solutions.

“Banks are in the business of lending. Technology, consumer experiences and many of the other property buying and sales processes are not of the banks' core business and competence,” he said. “Whilst we have recently seen one bank trying to branch into the property business directly as a bank, a quick use of its website simply shows a weak half-hearted portal and provides absolutely no comparison to existing similar platforms.”

For Cho, it’s the speed that counts. “Banks operate in a highly regulated environment, with many additional mission-critical concerns such as security issues, which limit their ability to ‘move fast and break things.’ I don't think tech alone can be a sustainable differentiator for startups though since banks have the financial resources to hire the technical talent,” he said.

“What will allow a startup to stand out is its ability to experiment with new business models at speed,” Cho added.

PropertyGuru, the largest listing of homes Singapore and one of the first proptech firms to ever exist, has been operating in the city for 11 years and has seen multiple entrants enter the online property space almost every year. “We have over 70% consumer market share and the most listings at any given point of time in Singapore,” said Lewis Ng, PropertyGuru Group’s chief business officer.

During the length of its stay in the landscape, PropertyGuru has absorbed lessons in proptech by investing in solutions. “We realise that in addition to the quantity of listings, what’s important to property seekers in Singapore is also the quality of those listings – and the tools added for the property seeker to evaluate those listings easily. We have invested most in data and technologies to enhance the quality of those listings backed by machine learning solutions,” Ng said.

Advertise

Advertise