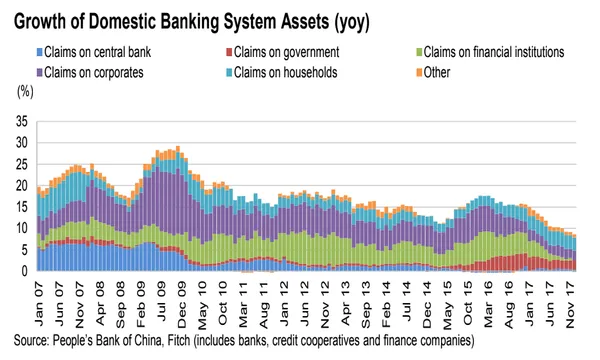

Chart of the Week: Here's a historical look at China's domestic banking assets

Claims on the corporate sector represent 36% of loans.

Claims on corporates continue to make up the larger share (36%) of Chinese domestic banking assets from 2007 to 2017, according to Fitch Ratings. However, household debt is soon catching up as banks increasingly ramp up their retail arms to cater to the household debt boom.

Here's more from Fitch Ratings:

Household debt has expanded by a compounded average of 20% a year since 2011, according to data from the People’s Bank of China. Rising claims on households became the largest component of new credit in the banking system and the major driver of China’s credit growth in 2017. It accounted for more than half of total new loans and 37% of banks’ domestic balance sheet growth in the face of credit tightening pressure in the corporate and financial sectors.

The banking sector has pivoted decisively toward retail business. Practically all commercial lenders are targeting faster expansion of short-term household lending and personal wealth management business, as regulators’ scrutiny of shadow banking and interbank activity deepens. Retail loans remain small, at 16% of banking system domestic assets, despite their rapid growth. This is substantially less than claims on the corporate sector, which make up 36% of assets (not including banks’ indirect exposure to corporates via non-bank financial institutions and wealth management products).

Advertise

Advertise