Singapore bank loan growth to recover from weak Q1

Loans could grow by up to 6% for full-year 2019.

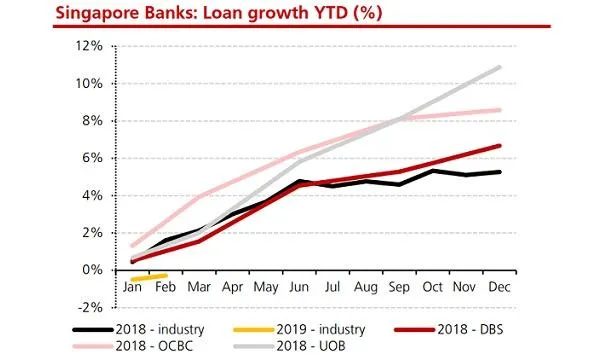

After a weak start to the year brought about largely by slowing business from the consumer front, the loan books of Singapore banks are set to recover with a full-year loan growth set to fall between 4-6% in 2019, according to a report from DBS.

Also read: Singapore mortgage loans to grow 3% in 2019

"Whilst industry growth has been weak in the first few months of 2019, we believe that Singapore banks’ loans growth will continue to outpace the industry as in 2018 where loan growth was buoyed by strong growth in Singapore and the region," analyst Rui Wen Lim said in a report.

The strong anticipated performance comes on the heels of momentum from Q4 where DBS, OCBC and UOB saw loan books grow by 1.3%, 0.4% and 2.6% respectively.

Also read: Regional gains boost Singapore bank loans amidst weakening domestic demand

Loans will also be supported by drawdowns by developers in relation to the enbloc transactions, as well as other deal-related pipelines.

“Beyond FY19F, we expect opportunities arising from Urban Redevelopment Authority’s (URA) newly announced draft master plan, as well as $9b-expansion by Singapore’s two integrated resorts in rejuvenating activities in the economy, alongside loan growth,” DBS said.

Advertise

Advertise