Indian banks maintain strong earnings momentum in Q4

Year-end interest income rose 15.6% amidst sustained credit recovery.

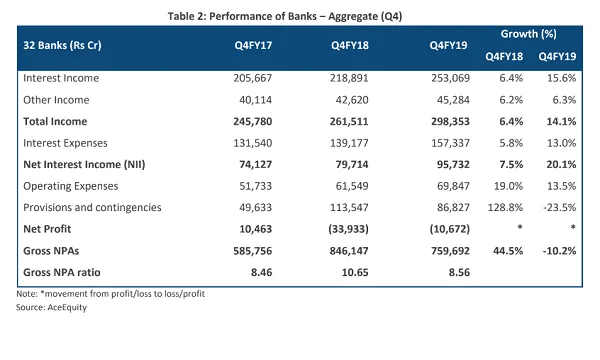

The Indian banking sector continues to demonstrate signs of sustained recovery in Q4FY19 as total income rose 14.1% YoY to $42.84b (RS 298,353 crore) in line with a steady credit growth, according to a report from CARE Ratings. Total income of private banks grew by 20.3% in Q4 and public sector bank (PSBs) income grew by 10.4% over the same period.

Also read: The worst is almost over for worn out Indian banks

Net interest income for both public sector and private banks picked up at a faster pace in Q4 at 20.1% from 7.5% in the same period last year. Net interest margin (NIM) also improved to 3.20% from 2.94%.

India’s bad loan situation also continues to recover, as gross non-performing assets fell 10% to $101.14b (RS 759,692 crore) and gross NPA ratio improved to 8.56% from 10.65% in Q4FY18.

The bad loans parked at PSBs fell 12.4% to reverse the 46% growth in soured assets in the previous quarter, correspondingly driving down the gross NPA ratio to 11.25% in Q4 from 13.81% last year. Gross NPAs of private banks also fell 2.4% and the ratio eased to 3.94% from 4.61%, signifying better asset quality of private lenders.

Also read: Indian banks successfully dent bad loans in 2018

“Credit to the agriculture and allied services are deployed majorly by the PSBs. The overall asset quality of PSBs is a concern as agriculture services is characterised by seasonal income and other uncertainties,” Sanjay Agarwa, senior director at CARE Ratings said in a report.

“The private banks on the other hand have higher exposure to the urban salaried base, which enables them to maintain their asset quality and consequentially to deliver a better RoA.”

Banks were also able to witness a steady growth in credit and deposits. Outstanding bank credit to agriculture and allied services rose to 7.9% in March and industry loans nearly expanded to 6.9% which more than offset softening figures in services and personal loans.

However, PSBs continue to take a beating as they succumbed to net loss of $1.53b (RS 10,672 crore) although the loss narrowed from $4.87b (RS 33,933 crore) in the previous quarter. On the other hand, private bank earnings surged 29.3% YoY.

The return on assets (RoA) of private and public banks improved from -0.82% in Q4FY19 to -0.22% in Q4FY18 with the former improving to 0.41% from 0.40% and -2.04% to -0.94%.

Advertise

Advertise