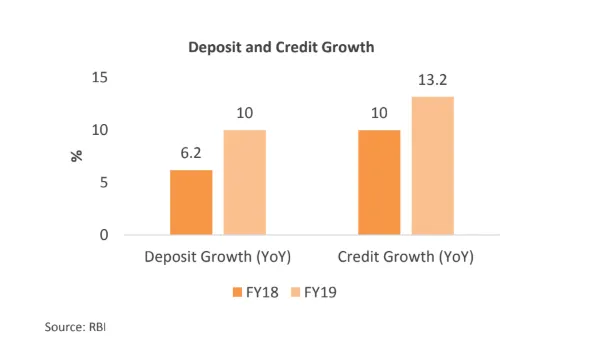

Chart of the Week: Indian banks' credit growth hit 13.2% in mid-April

Deposits grew by 10%.

Indian bank credit picked up at a faster pace at 13.2% in mid-April, according to data from the Reserve Bank of India (RBI) cited by a Care Ratings Report. This is higher compared to the 10% credit growth for the same period a year ago.

“For both the financial years (FY18 and FY19), bank credit growth has surpassed deposit growth. In FY19, this has been a key factor constraining liquidity in the banking system,” the report noted.

Also read: Indian banks hit by liquidity crunch

Deposit growth came in at 10%, higher by 3.8% compared to the figures a year ago.

The positive development comes as Indian banks are slowly recovering from their crippling bad loan burden and achieving gains from their lending businesses. “[W]e expect the gradual cleaning up of non-performing loans in the banking sector to be supportive of new loan issuances over the coming quarters, and this should support the continued expansion of financial services,” Fitch Solutions said in an earlier report.

Advertise

Advertise