Tech upstarts woo locals as Singapore retail banking customer satisfaction falls

65% are interested in opening digital bank accounts, up from 52% in the previous year.

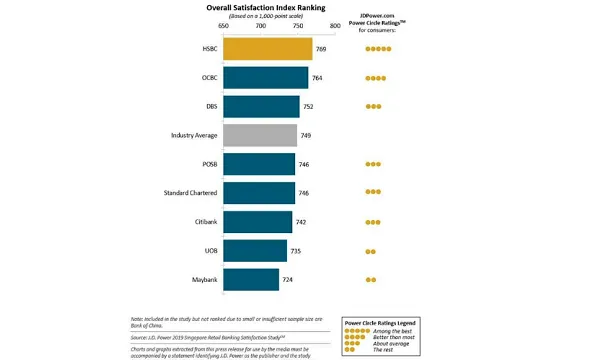

Banks in Singapore grapple with declining customer satisfaction levels which fell to 749 on a 1,000-point scale in 2019 from 755 in the previous year, according to a survey from market research firm J.D. Power.

In terms of specific banking provider, HSBC pulled ahead of local players to rank the highest in retail banking customer satisfaction with a score of 769 amidst resilient performance in product offerings, fees and problem resolution. OCBC followed closely at second place with a score of 764 and DBS rounded out the top three with a score of 752. UOB ranks at seventh place, behind POSB, Standard Chartered and Citibank.

Also read: Is branch banking still relevant as Singapore lenders migrate their services online?

Despite the decent showing by banks in meeting customer needs, more than half (65%) of customers have expressed interest to open digital bank accounts in 2019, up from 52% in 2018. Seven in ten customers born in or after 1980 have also raised their hands for the digital banks, compared with 59% for the remainder of customers.Although non-branch users are receptive to digital banks (64%), regular branch users are just as willing to using digital banks (66%).

Of the customers with multi-account programmes designed to deepen relationships with customers, 23% are likely to switch their primary bank providers over the next 12 months compared with 14% of customers who are not using multi-account programmes, bringing into question whether this move by the banks to increase customer loyalty is actually achieving its purpose.

“Customers are the winners when they have more choices,” Anthony Chiam, Regional Practice Leader, Global Business Intelligence at J.D Power said in a statement. “On average, customers in Singapore have about five accounts, which include transaction, savings and deposit. If banks build relationships and help customers navigate financial planning complexities, they will benefit from the lifetime value of the customer.”

Also read: Virtual banks may only account for less than 1% of Singapore loan market by 2022

The Monetary Authority of Singapore (MAS) earlier announced that it will be issuing up to two full digital banking licenses and three wholesale as part of an effort to liberalise the financial services sector. In a similar move, Hong Kong earlier issued a total of eight virtual banking licenses and Taiwan also granted approvals to three consortiums in July.

The 2019 Singapore Retail Banking Satisfaction Study examines customer satisfaction with the products and services provided by their primary financial institution using metrics like account activities; account information; facility; product offerings; problem resolution; and fees.

Advertise

Advertise