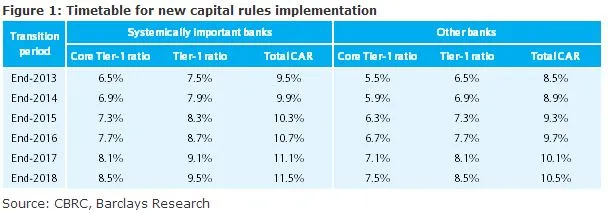

Check out CBRC's detailed timetable for new capital rules implementation

The rules will be implemented from 1 January 2013.

According to Barclays, the China Banking Regulatory Commission (CBRC) issued a notice releasing a detailed timetable for banks’ new capital rules implementation on its official website. According to the notice, all commercial banks will start implementing new capital rules on 1 January 2013, with a transition period of six years. Banks are required to calculate their Tier-1 ratio and CAR based on their financials as of end-2012, set up their own implementation timetable, and hand in the plan to CBRC by end-March 2013.

Here's more from Barclays:

Detailed timetable for new capital rules implementation is shown in the figure, systemically important banks (SIB) should meet the minimum core Tier-1 ratio, Tier-1 ratio and CAR of 6.5%/7.5%/9.5% at end-2013, and up 40bps per year in the next 5 years to meet 8.5%/9.5%/11.5% by end-2018, respectively; requirements for other banks are 1ppt lower than that for SIB.

In addition, the notice stated that banks, who have already met the requirement, are encouraged to keep their Tier-1 ratio and CAR above the requirement during the transition period; and banks, who have not met the minimal requirement, are required to meet the yearly requirement set in the timetable.

Still no definition for SIB

The regulator still hasn’t clarified the definition/classification of SIB, nor given the SIB list. However, China’s big five banks, including ICBC, CCB, ABC, BOC, and BOCOM, are believed to be included in the list.

Reinforces no near-term capital-raising pressure

In our view, the newly released timetable should help reduce market concerns over banks’ capital replenish pressure in 2013/2014, as most banks have already met the minimum requirement set by the timetable. Although Minsheng and CMB’s Tier-1 ratios are still below the minimum requirement, there should be no pressure for them to meet the minimum requirement of 6.5% set by end-2013. In addition, both banks have already announced A-share capital raising plan, which now pending for regulator’s approval.

Six large banks plan to move to IRB offset any capital drop at beginning of the year in 2013

Furthermore, the first batch of six banks, including ICBC, CCB, ABC, BOC, BOCOM and CMB, are planning to apply to implement the Internal Rating Based (IRB) approach in 2013. If approved by CBRC, we estimate the IRB approach could lift banks’ capital ratios by >1% for most banks, which will further relief banks’ capital raising or dividend reducing pressure, in our view.

New hybrid will be allowed

At the same time, CBRC released guidance on non-core Tier-1 capital instruments, banks are encouraged to study/develop new non-core capital tools, which will be subject to regulators’ further approval. We believe possible tools might include hybrid capital and contingent convertible bonds (CoCo bond).

Trigger events for write-down or conversion of hybrids

CBRC also clarified the triggering events for the write-down or conversion of non-core Tier-1 capital instruments and Tier-2 instruments. Non-core Tier-1 capital instruments triggering event is defined to be when the bank’s core Tier-1 ratio fell to 5.125% or below. And Tier-2 capital instruments triggering event is defined to be when bank will not able to survive without: 1) the write-down or conversion of the instrument approved by CBRC; 2) capital injection or equivalent support by related department.

Takes time for hybrid products to reach the market

We believe it will take at least a year for banks and regulators to study and introduce the new capital instruments as they as they will require some break-through in current corporate law and financial product regulations.

Advertise

Advertise