FinTech companies drive crucial cross-border transactions

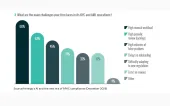

The demand for faster payments, cheaper costs, and payment flexibility are three big trends for cross-border transactions.

The surge in demand for faster, cost-effective, and transparent payment solutions is fueling the growth of cross-border payments in the Asia-Pacific region, with FinTech players like Airwallex positioning themselves to meet the evolving needs of their customers.

“We’re seeing a lot more demand for cross-border payments because more businesses see the need to source overseas and tap into international markets. The three big trends that we’re seeing are, first, the demand for faster payments, second, the demand for cheaper costs, and lastly, the need for more transparency and flexibility in payments,” Cher Hao Low, Head of SME & Growth Singapore at Airwallex said.

This shift in demand is creating an environment where cross-border payments are experiencing rapid growth across APAC, driven by providers who are stepping up to deliver on these customer expectations.

Low highlighted two key strategies that FinTechs are employing to capitalize on the growing momentum in the market. “Building out an extensive infrastructure that ensures customers have the ability to make payments fast, cost-effectively, and transparently across all the markets that they want to operate in. Secondly, we build out a software layer that helps customers reduce the amount of operational effort that they need to incur to manage their global payments.”

He said that the rise of cross-border payments is not limited to consumer-facing businesses. Business-to-business (B2B) transactions, which often involve more complex payment processes, are also seeing significant innovations aimed at simplifying operations and improving efficiency.

Low identified three key innovations that are currently reshaping the B2B payment landscape which includes embedded finance, real-time cross-border payments, and automated bank reconciliation.

He said these innovations are particularly significant for small and medium-sized enterprises (SMEs), which may lack the resources to manage the complexities of cross-border payments without the support of advanced financial technologies.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership