APAC banks slow to update decision rules: survey

Just 27% of banks report frequent use of simulation tools.

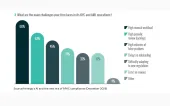

Nearly half (48%) of banks in the Asia Pacific region still take months to employ new decision strategies such as fraud detection rules, or adjusting credit risk models, according to a study by FICO.

This is despite nearly two-thirds (63%) of 30 senior bank leaders polled in Singapore saying that updating decision strategies are a top priority, the study found.

The poll also reveals a limited uptake of advanced testing capabilities, the data analytics company said.

Just 27% of banks report frequent use of simulation tools, such as digital twins— virtual replicas of systems used to model responses to change.

This may indicate a preparedness gap as banks face increasing complexity in customer behavior, regulation, and risk, FICO said.

More than half (53%) of bank leaders view business composability—the ability to reconfigure and scale operations quickly—as critically important to remaining responsive in volatile markets.

FICO conducted the poll during a customer event in Singapore in late 2024, drawing insights from over 30 senior executives and C-suite leaders from banks across the Asia Pacific region.

Advertise

Advertise