Asia’s regulators need to match banks’ digital pace, GFTN says

Good regulation, he argued, should function as “a safety belt, not a brake."

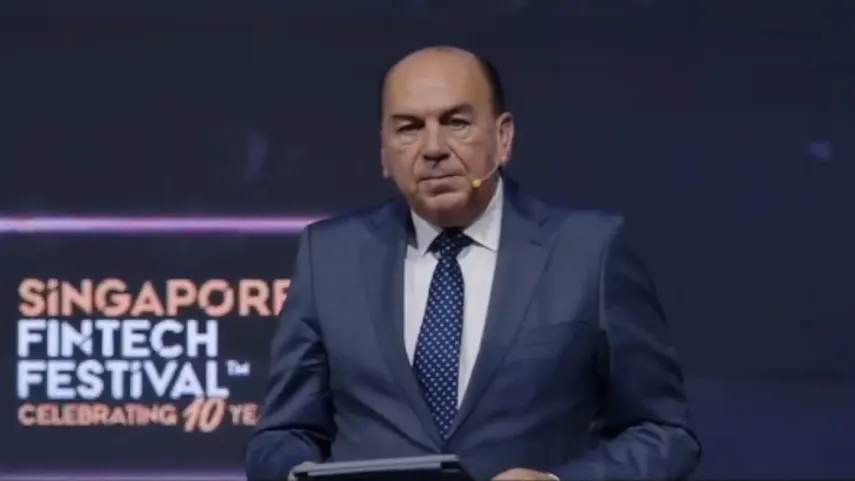

Asia’s financial regulators are urged to catch up with the banking industry’s digitalisation pace amidst a possible new wave of oversight, Dr. Axel Weber, International Advisory Board Member, Global Finance & Technology Network (GFTN) & President, Center for Financial Studies, GFTN, said.

“I think the key innovation for digital finance is a safe space to experiment under supervision and if needed, with intervention by the regulator,” Weber said at the Singapore Fintech Festival 2025 during the "A Decade of FinTech: Impact on Financial Services and Regulation" opening session held at the Festival stage on 12 November.

“And that has been, in my view, an approach that has so far not been adopted far enough in every part of the financial world,” Weber said. “When tech was sprinting, regulators, at least 10 years ago, were still tying their shoes,”

He credited the Monetary Authority of Singapore (MAS) and the UK Financial Conduct Authority (FCA) for pioneering Regulatory Sandboxes – controlled environments for testing new financial products – calling them “the key innovation for digital finance,"

Good regulation, he argued, should function as “a safety belt, not a brake,"

Weber identified a new wave of oversight he called “Regulation 2.0”, driven by coordinated international efforts such as the US Genius Act, the EU’s MiCA framework, and initiatives by the Bank for International Settlements (BIS).

“Global regulation is catching up fast,” he said. “The regulators are trying to make sure that the next big idea… doesn’t break the financial system or the economy,”

Weber said the decade-long fintech story has been a dramatic acceleration of financial access and efficiency.

“Money has gone digital. Banking has become digital for everyone, everywhere, all the time,” he said.

He highlighted how services like Kenya’s M-PESA, China’s WeChat Pay and Alipay, and Western neobanks such as Revolut and Chime compressed centuries of banking evolution into less than ten years.

“Fintech didn't just make finance faster. It made it cheaper, it made it easier, and it made it fairer,” he said. “We saw the rise of alternative finance. I'm looking at a decade that we talk about, and actually crowdfunding, peer-to-peer lending and neobanks, they all have one thing in common. They built what traditional banks built in over 300 years,”

Weber noted that technology has not only changed how money moves but also how data shapes financial outcomes.

“Fintechs now reach your financial soul through data, from your phone usage to your spending habits,” he said.

These patterns, he warned, can influence “your health insurance premium or your credit score,” raising the importance of data ethics and oversight.

Looking forward, Weber said the next decade will be defined by AI, embedded finance, and tokenisation.

Financial services, he predicted, “will soon be invisible… running in the background” of daily life.

Tokenisation, he added, will let individuals “own 0.01% of a skyscraper here in Singapore, or a square inch of a Picasso painting,"

Weber concluded that the next phase of fintech will be defined not by disruption but by disciplined integration.

“Banks are learning to innovate, startups are learning to comply, and regulators finally are starting to relax,” he said. “The future is not man versus machine, it’s man with the machine,"

Advertise

Advertise