Mastercard bets on ‘agentic commerce’ to transform payments

Central to this effort is Mastercard’s Agent Pay framework.

Mastercard is placing its bets on artificial intelligence (AI) to redefine the way transactions are conducted, with a strong focus on what the company calls agentic commerce, which it sees as the next major wave of growth in digital payments.

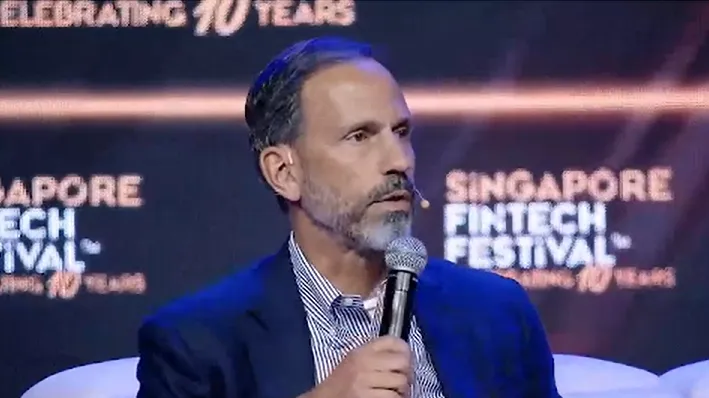

Speaking at the 'C-Suite Insights: Roadmap for AI in Financial Services' session at the Singapore FinTech Festival 2025, Craig Vosburg, chief services officer at Mastercard, said that the company is investing in projects aimed at “improving the quality and effectiveness of our products, things like fraud detection and dispute resolution and personalisation.”

Vosburg said agentic commerce is the company’s main focus. “I'd say the one that we're most excited about, in terms of the impact it can have on our organisation and for many of our partners, is the evolution and advent of agentic commerce."

“The potential for that to completely transform the way in which commerce is conducted, in having agents not just assist in search and identification, but ultimately the completion of transactions on a consumer or business's behalf,” he continued.

Vosburg said Mastercard is dedicating significant resources to ensure that agentic commerce is safe, secure, and delivers a seamless experience for users.

At the core of this effort is Mastercard’s Agent Pay framework, designed to establish clear standards and security protocols for transactions involving agents.

Vosburg described the framework as one designed to identify known and unknown agents, track those engaging in commerce, set standards for the technology and data associated with transactions, and enhance consumer authentication to ensure that the person instructing the agent is authorised to do so.

The framework also creates an audit trail, enabling a clear understanding of whether consumer intent aligns with the agent’s instructions and the merchant’s actions, particularly in cases of disputes or erroneous transactions.

Vosburg described agentic commerce as ushering in a new paradigm in commerce.

He explained that whilst physical transactions, e-commerce, and mobile commerce have driven tremendous growth, agentic commerce represents a new wave of opportunity.

“We think is, is a new wave of growth and opportunity that just creates, reinforces the importance of and creates real opportunity for those of us who are engaged in in digital transactions and digital commerce,” said Vosburg.

Looking to the future, Vosburg highlighted Mastercard’s broader ambition in this space. “I believe my organisation’s greatest legacy will be helping to shape the future of commerce in a way that's fit for purpose in an agentic world, it's ubiquitous, secure, delivers great consumer experience and is broadly inclusive for consumers and businesses to continue empowering people, empowering economies around the globe.”

Advertise

Advertise