Foreign institutions pursue market entry as Japan strengthens fintech rules

Reliability defines Japan’s fintech advantage in Asia

Foreign financial institutions highlighted the need to work through trusted institutions and align with Japan’s supervisory environment amdist a growing attractive financial technology (fintech) environment.

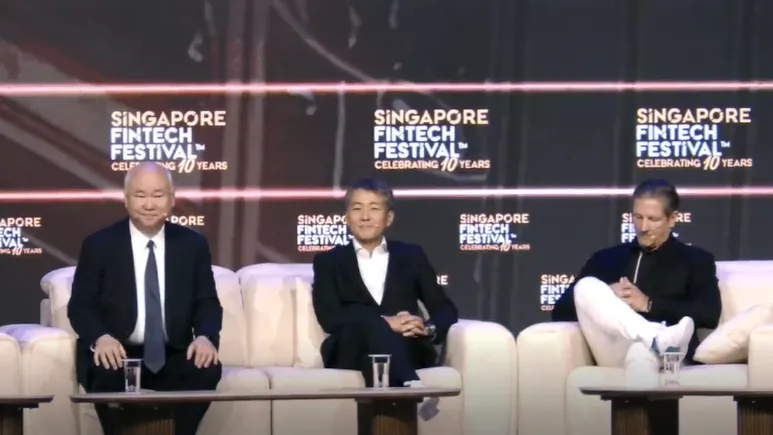

Foreign participants also emphasised that partnerships are essential for entering the Japanese market because of consumer expectations and regulatory precision, industry leaders said during the “Japan’s FinTech Frontier: Investing in Innovation and Inclusion Across Asia” session at the Singapore FinTech Festival 2025 on 14 November.

“They’re digitally savvy, very protection-oriented, and you have a regulator who’s extremely sophisticated and disciplined,” said Rob Schimek, Group CEO of bolttech.

The panel agreed that Japan’s fintech trajectory is shaped by diversified forms of collaboration.

“Acquisition is one thing, but there are more strategic investments… and new types of banking-as-a-service creating new value propositions,” said Makoto Shibata, Chief Community Officer and Head of FINOLAB. These models allow both incumbents and new entrants to deliver services within existing institutional frameworks.

Shibata outlined how this collaborative environment developed over a decade. “We (FINOLAB) started with five startups, and now we have 57 members, including 17 international startups,” he said. He added that the wider Japanese ecosystem now includes “600 or 700” fintech companies, reflecting stronger integration with major financial institutions and fewer stalled proofs of concept.

Masashi Namatame, Senior Managing Executive Officer and Group Chief Digital Officer of Tokio Marine Holdings, described how digitalisation reshaped Japan’s financial sector and reduced boundaries between banking, insurance and telecommunications. “Most recent 10 years have been just amazing, because Japan's digital innovation in the banking industries have been almost entirely unlocked,” he said.

Regulatory reforms have expanded the range of services incumbents can offer. Updates to banking and insurance rules have enabled diversification into new business areas, whilst the Financial Services Agency’s FinTech Week created a national platform for engagement among startups, technology providers and institutions. “Japanese regulatory environment has now become extremely supportive to innovation and technology and partnerships,” Namatame said.

Shibata added that new collaboration models, such as banking-as-a-service, are widening access for underserved groups. He cited banks enabling foreign nationals in Japan to access deposit and remittance services through a streamlined structure.

The panel reinforced that Japan’s fintech direction is defined by coordinated development rather than disruption. Regulatory clarity, institutional trust and demographic needs continue to shape how both domestic and foreign firms participate in the market.

Advertise

Advertise