Standard Chartered's voice & virtual head Stuart Beaumont reveals why call volume to their contact centres declined 12%

Yet conversation lengths are longer, complaints are lower and sales are higher.

Stuart Beaumont is the Global Head, Voice and Virtual, Retail Banking, for Standard Chartered Bank. Based in Singapore, Stuart is responsible for transforming service delivery and improving service standards in the bank’s Client Contact Centres. He provides strategic direction to over 5,000 employees across 23 locations in Asia, Africa and the Middle East.

Prior to joining Standard Chartered, Stuart was the Managing Director of Serco Global Services, one of Australia's most successful and largest BPO businesses. Before this, he was the Executive General Manager at Salmat, a leading Australian BPO business, with over 3,000 staff and 50 contracts across 3 countries.

In an exclusive interview with Asian Banking and Finance, Stuart talks about their latest digital offerings as well as the evolving contact centre landscape.

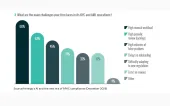

ABF: What are your thoughts on the changing roles of contact centres from service resolution to deepening relationships and needs-based conversations? What have you experienced at Standard Chartered?

We are experiencing the change and embracing it. Clients now prefer to choose the time, place and channel to interact with us. It’s our role to make it easy for them, so we are now offering multiple channels – from mobile to online to phone to chat and videobanking.

No longer is the contact centre simply a place for service resolution. Our consultants are engaging in needs-based conversations which are aligned to our clients’ needs. So it’s offering to set up a sms payment alert when your client asks for a late fee waiver, or offering your client a savings product when they are saving up for a holiday.

Our experience in Standard Chartered shows that call volume to contact centres is down 12%, yet conversation lengths are longer, complaints are lower and sales are higher. This is because the contact centre is now a preferred channel for clients to have a conversation with their bank, be it a service request, or to find out about a financial product.

So we are training our consultants to be active listeners, to have strong product knowledge and to present solutions to clients.

ABF: How can banks utilise/improve data analytics to increase efficiency in contact centres?

Analytics help us to understand and serve our clients better. We use analytics to have better and more personalised conversations – we understand why the client is calling and can at times pre-empt their needs. We can then route them to the best person who can help them with their enquiry.

By better understanding past history and behaviour, we can tailor our products and services more seamlessly and also to proactively contact clients who might be interested in those products and services.

A very interesting new area we are exploring is speech analytics which analyzes speech patterns and key phrases, helping us understand real-time client needs and resolve issues more effectively.

ABF: Please tell us about your specific experiences with the recent rollout of video and chat banking. How important is technology's role in providing convenient service to clients?

Video and chat banking is changing the relationship between the bank and our clients. This is a personalised and staff-assisted way for clients to interact with the bank without having to visit a branch. This channel complements our mobile and online banking apps which allow clients to perform transactions like payments and fund transfers on their own.

Client feedback so far has been strong and positive. They like the convenience and efficiency of being able to connect with a consultant immediately without having to visit a branch or queue.

Technology is very important in delivering convenient service to clients. The consumer now dictates how they wish to converse with an organisation. The organisation who adapts best will win client loyalty. As part of the bank’s strategy, Standard Chartered has committed to invest USD1.5bn in technology over three years.

ABF: You recently announced that you are rolling out fingerprint and voice biometrics to more than 5 million clients across Asia, Africa and the Middle East. What was the thinking behind it?

Fingerprint and voice biometric technologies give our clients more convenience and security when they want to access their bank balances, cards and investments, wherever they are and whenever they want. Instead of trying to remember their password or PIN, they can use their unique fingerprint or voice as an identifier. We’re bringing the latest digital technologies to all our markets so that we can offer easy, convenient and secure banking to our clients.

ABF: What do you consider as your biggest achievements so far as the Global Head of Voice & Virtual at Standard Chartered?

I’m proud of the team for lifting the profile of the contact centre as a preeminent channel for client conversations and as a revenue generator for the bank.

We’ve also been able to introduce many new innovations such as video and chat banking and voice biometrics, which have improved the quality of our service to our clients.

ABF: What are your key business philosophies?

To put the client first in all business decisions. Without clients we don’t have a business. This means we need to focus on making banking simpler for clients; reducing effort and streamlining processes.

Have a Fail fast mindset. In today’s rapidly changing world we can’t afford to develop complex and long- winded solutions. We need to test and learn in a controlled manner to ensure our solutions meet the needs of our clients.

Execute! Telling your clients what you are going to do is never as powerful as doing it for your clients. It is never real in the bank until the client experiences a more positive engagement.

ABF: What three goals are you focused on in the next 12 months?

We aim to roll out our new digital channels to more markets and continue to introduce new innovative technologies which enhance the client experience.

We will continue to improve service levels by developing our consultants so that they have the knowledge, skills and most importantly the motivation to deliver when it matters.

We will aim to deliver a seamless client experience. So whether you are engaging with us at a branch, on the mobile banking app, or via video and chat banking, our clients will have a positive banking experience that gives them convenience, choice and security.

Advertise

Advertise