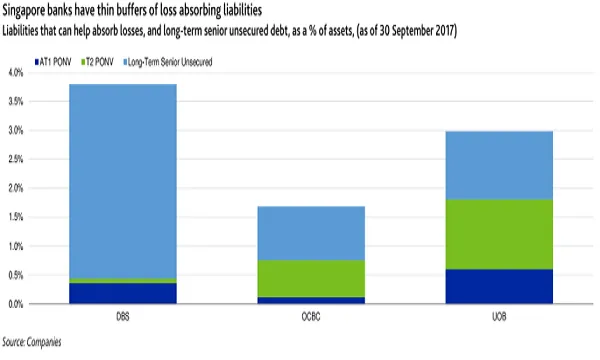

Chart of the Week: Singapore banks have thin buffers of loss absorbing abilities

There is not much to bail in at this stage.

Moody's noted that as a result of limited financial buffers provided by outstanding bail-in-able liabilities (Tier-2 and AT1 PONV securities), government support for the large banks will be forthcoming if needed.

"The MAS is of the view that while a broader bail-in scope would increase the loss-absorbing capacity of a bank, it would also raise the risk of contagion to the financial system and broader economy from a bail-in of bank liabilities and increase funding costs for banks," said Moody's.

Advertise

Advertise