Hong Kong

BEA’s profit down 24% to $447.87m in 2025 as China losses mount

BEA’s profit down 24% to $447.87m in 2025 as China losses mount

Commercial real estate (CRE) accounted for 77% of BEA’s loan loss provisions.

3 days ago

APAC fintech exits hit $8.8b in H2 2025 as Hong Kong IPOs rebound

In contrast, IPO activity in Australia was “dry”, said KPMG.

6 days ago

Chubb launches Chubb Wealth with no platform fees for HNWs

Minimum investment for mutual funds starts for as low as US$100.

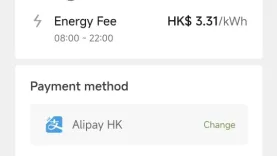

Antom and XPENG add AlipayHK payments across 1,600 EV chargers

The service is available in Hong Kong and will expand to SEA markets later in 2026.

Greater Bay Area loan access index sinks to 48.7 as recovery reverses

Quarterly business confidence data shows lending conditions falling back into contractionary territory.

DBS Hong Kong names Xu Qing as managing director and risk head

Xu will oversee all credit and risk functions in Hong Kong, mainland China, and Taiwan.

CLP Power and HSBC launch first ESG-linked supply chain finance deal

ESG-linked terms tie funding to emissions metrics.

BEA signs UN responsible banking pact

The principles are supported by over 360 banks globally.

Dah Sing Bank launches multi-currency debit card for SMEs

It enables overseas payments across 11 currencies with no foreign currency transaction fees.

Hang Seng Bank delists from Hong Kong Stock Exchange

Registered shareholders to receive payment via bank transfer or cheque.

WeLab Bank kills FX fees with multi-currency debit card

The new Mastercard allows spending in 11 currencies at "at-cost" prices.

HSBC gains court sanction for Hang Seng Bank privatisation scheme

Capital reduction clears path for planned Hong Kong delisting

Hong Kong expands RMB facility to $28.6b after banks hit quotas

The initial quota had been fully allocated to 40 banks.

BOCHK capitalisation strong but property risks remain

Fee income and treasury income will support its profitability through mid-2027.

PAObank uses PCS to replace traditional freight documentation

PAObank is the first digital bank to participate in the commercial data interchange initiative.

Crédit Agricole CIB names Yang Zhang as head of cash and trade sales for APAC FIs

She will oversee business development and origination of cash management.

DBS Hong Kong unveils new SME sustainable finance program

Eligible uses include energy efficiency upgrades, resource conservation, and clean transportation.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership