Automation stalls hiring at Singapore’s top banks

Lenders are also upskilling to keep up with tech.

The headcount at Singaporean banks either fell or rose by only a single digit last year, as some lenders cut jobs due to automation, whilst others limited hiring to relationship managers and tech experts.

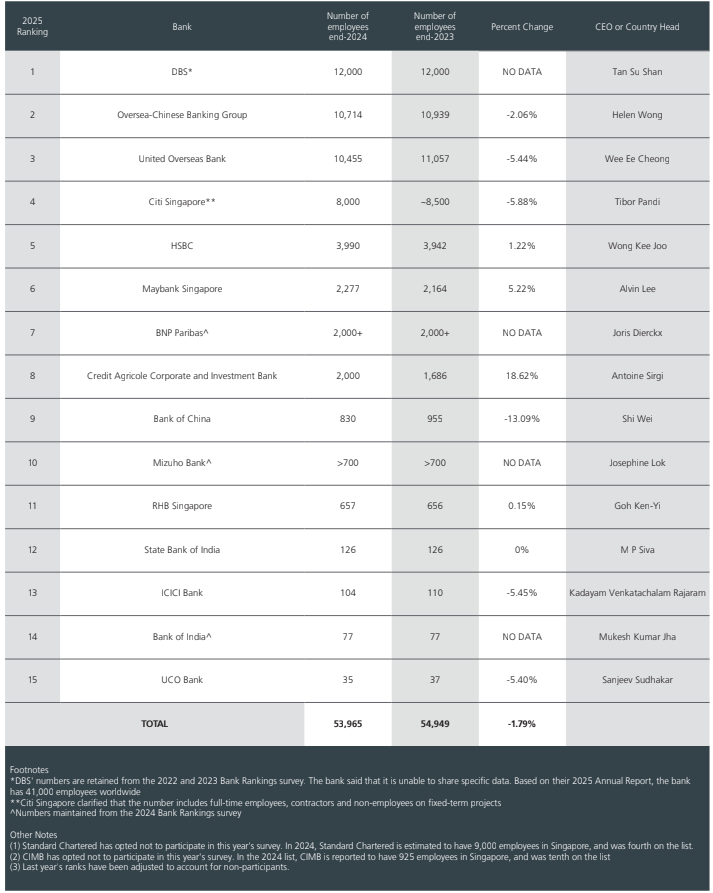

The fifteen banks included in this year’s edition of the bank ranking survey employed about 54,000 people by end-2024, 1.79% lower than a year earlier.

Bank of China posted the biggest decline at 13% or 855 workers. On the other hand, Credit Agricole Corporate and Investment Bank added 314 employees to 2,000, 18% more than a year earlier.

Oversea-Chinese Banking Corp. Ltd. (OCBC) swept past United Overseas Bank Ltd. (UOB) to take the second spot, with 10,714 workers. UOB had about 600 fewer people on its payroll, compared with OCBC losing 225 workers.

OCBC noted changing customer expectations and tech.

“From 2018 to 2025, we have committed over $80m towards employee development and mobility,” Ernest Phang, managing director for group human resources at OCBC, told Singapore Business Review.

This includes growth and job mobility opportunities for its employees, apart from reskilling and upskilling programs. “Currently, we offer more than 29,000 programmes across OCBC,” he said in an emailed reply to questions.

OCBC said that they continue to be on the lookout for talents that can add value to the team and are also a right fit for the bank. "Our recruitment activities across the different divisions in the bank are in line with our identified areas of growth, and hiring activities are carried out when the need arises."

Like OCBC, Maybank Singapore said that it remains a strong advocate for grooming internal talent.

“We anticipate more focused recruitment in business lines tied to digital transformation, data analytics, cybersecurity, customer experience innovation, compliance, wealth management, and global banking,” said Wong Keng Fye, head of human capital at the bank.

The bank, whose parent Malayan Banking Bhd is Malaysia’s biggest bank by assets, added 113 workers to 2,277, the second-fastest increase after Credit Agricole.

Wong said their hiring priorities this year revolve around digital, data, and technology. “Emerging technologies such as artificial intelligence (AI), cloud, and big data analytics are reshaping the skillsets we prioritize.”

Meanwhile, HSBC Holdings Plc, whose headcount rose 1.2% to 3,990, said wealth management and digital banking are central to its business strategy and human resource priorities.

“In wealth management, which remains a growth driver for HSBC in Asia, we're continuing to focus on client-facing, relationship management, and customer service positions to support our ambition to be Asia's leading wealth manager,” said Mukul Anand, head of HR at HSBC Singapore.

‘Digitally savvy’

RHB Singapore is also looking to hire more relationship managers.

“A key focus area is retail banking, where we anticipate continued growth, particularly in hiring relationship managers to support wealth products as part of our expansion strategy,” Jensong Tng, head of human resources at RHB Singapore, told Singapore Business Review.

“We are also prioritising talent with expertise in regulatory compliance, financial crime, risk, and Treasury, particularly those with cross-border experience and are skilled in operational excellence and digital process transformation,” he said in an email.

Both HSBC and RHB cited the need for real-time, hyper-personalised, and seamless digital banking experiences.

HSBC’s Anand said customer expectations for a hyper-personalised, frictionless experience with a blend of digital convenience underscores the need to hire digitally savvy talent.

“This dual expectation is driving our approach to hire talents who are digitally savvy, especially in wholesale banking where we have market-leading transaction banking platforms,” he said.

RHB’s Tng, meanwhile, said that they are investing in people who could work on intelligent automation, cloud infrastructure, and sustainable banking solutions.

“We are placing greater emphasis on developing internal talent, particularly in roles that support digital enablement, customer excellence, and sustainability,” he said. This includes structured upskilling programmes in data analytics and cross-border banking, he added.

Whilst banks are prioritising hiring and upskilling to keep up with advanced technology, tech is also being cited as a reason for increased retrenchments, a hiring expert said.

“There has been an increase in retrenchments due to the shifting structure of banking,” said Serena Fernando, a senior consultant for banking and financial services at Robert Walters Singapore.

The rise of AI and automation means people must upskill and take on more sophisticated tasks, she said in an email.

“For customer service roles, we are already seeing chatbots being introduced and the number of hires for customer service has dipped, with some banks making huge cuts in headcount,” she added.

The Johor-Singapore Special Economic Zone and higher US tariffs could be positive for job seekers in Singapore’s banking industry.

“This is relatively newly launched, but there are banking institutions that have already discussed potential synergies,” Fernando said.

Six financial institutions have been roped in to support investment growth in the zone—Bank of America Corp., HSBC, Sumitomo Mitsui Banking Corp., CGS International Securities Singapore Pte. Ltd., Maybank and CIMB.

“This could mean more operational or manual work being offshored to this area, or level one technical support roles,” she said.

‘Contracting route’

US tariffs and trade uncertainties could lead to companies, including banks, moving roles from Hong Kong to Singapore to hedge against geopolitical uncertainties.

“Some clients are opting to retain their existing Hong Kong footprint, but to expand into Singapore as a second Asia-Pacific office for business contingency reasons, and also to use Singapore as a gateway to access investment opportunities in Southeast Asia,” Fernando said.

Banks in Singapore are hiring fewer people—or not at all—as corporate spending hits a brake to stay liquid, said Ken Ong, managing director at recruitment consultancy Morgan McKinley’s Singapore operations.

“Even the volume of replacement is not in proportion to the attrition level,” he said, noting that for every two people who resign, only one post gets replaced.

Ong expects bank hiring to slow this year, although some posts remain in demand, including relationship managers and roles in wealth management and family offices.

“Bulge bracket banks are not hiring as many,” he said via Zoom. “However, the second-tier banks, specifically Asian banks, still have a certain appetite in the market for some strategic [hiring] moves.”

Ong said second-tier banks are still hiring specialized workers who will help them boost their cybersecurity, cloud investment, and data analytics.

Much of the hiring is limited to contract workers and project-based roles as Singapore’s economy is expected to be flat this year, he pointed out.

“When they look at that sort of projection, then they will also take a step backwards from hiring for a replacement role,” he said. “A lot of banks also just want to have more agility with their cash flow and make sure that they have a bit of cushion.”

“The main challenge currently in the market is that everyone is just being very cautious,” he added.

There has also been a shift among workers, from bankers moving to fintech to Hong Kong posts being moved to Singapore, Ong said.

Employers are also using contractual work to test employees before offering them a permanent job.

“Most clients are happy to explore the contracting route to validate performance.”

New hires themselves seek job contracting to explore what career paths they want.

“Unlike the old times where they were told to get into a role and become a specialist very earlier in their career, they prefer to get a variety of exposures before deciding what specialization they want to get into,” Ong said.

Advertise

Advertise