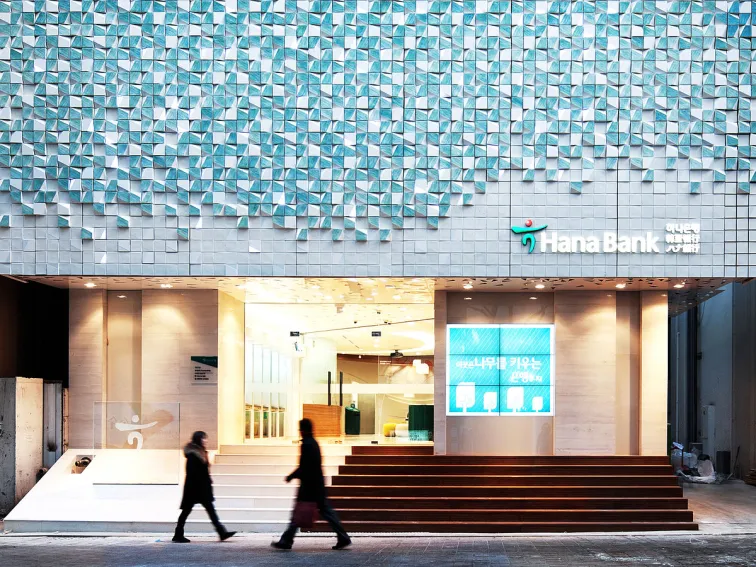

South Korea’s Hana Bank floats $600m in ESG bonds: report

It carries an annual interest rate of 1.25%.

South Korean lender Hana Bank has floated $600m-worth of environmental, social, and governance (ESG) bonds, reports Yonhap.

The dollar-denominated bonds are aimed to help support vulnerable and eco-friendly projects, the bank said.

It will mature in five years and six months, and carry an annual interest rate of 1.25%, or the yield on five-year U.S. Treasurys plus a spread of 0.55 percentage point (ppt).

The bond issuance is co-managed by Citigroup Global Market Security, Credit Agricole, HSBC, Mitsubishi UFJ Financial Group and Standard Chartered.

Advertise

Advertise