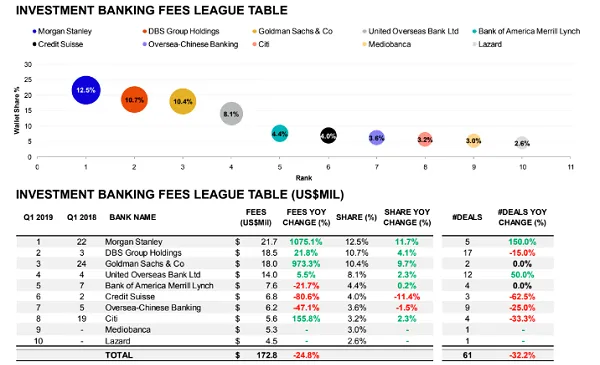

Singapore investment banking fees down 24.8% to $172.8m in Q1

Advisory fees from M&As plunged 63.6% even as deal numbers rose.

Singapore investment banking fees crashed 24.8% YoY to $172.8m in Q1, according to data from Refinitiv.

Also read: China's crowded investment banking scene squeezes fees to five-year low

Investment bankers from Morgan Stanley earned the most fees in Q1 after taking home $21.7m or a 12.5% share of the total fee pool. DBS came in at second place with an $18.5m fee haul and 10.7% market share whilst Goldman Sachs rounded out the top three with an $18m haul and 10.4% market share.

Advisory fees for completed M&A plunged 63.6% YoY to $45.2m from a strong $124m in the previous year. This comes even as deal numbers rose with overall announced M&A activity in Singapore hitting $24.2b to mark the strongest start since 2014 when proceeds hit $30.8b.

Underwriting fees for the equity capital markets skyrocketed 279.1% YoY to a six-year high of $60.8m, whilst fees from DCM underwriting rose 14.9% to $51.9m.

On the M&A front, JP Morgan emerged as the top financial advisor with a 33% market share and $7.9b in deal value. Morgan Stanley and Goldman Sachs share the top spot in the ECM underwriting rankings with 34.2% market share each. DBS leads the Singapore bonds underwriting with $1.8b in related proceeds and capturing 24.4% market share.

Advertise

Advertise