Which structured finance market in APAC will fare best?

Fitch sees stable to improving asset performance in ANZ and Japan as China slips.

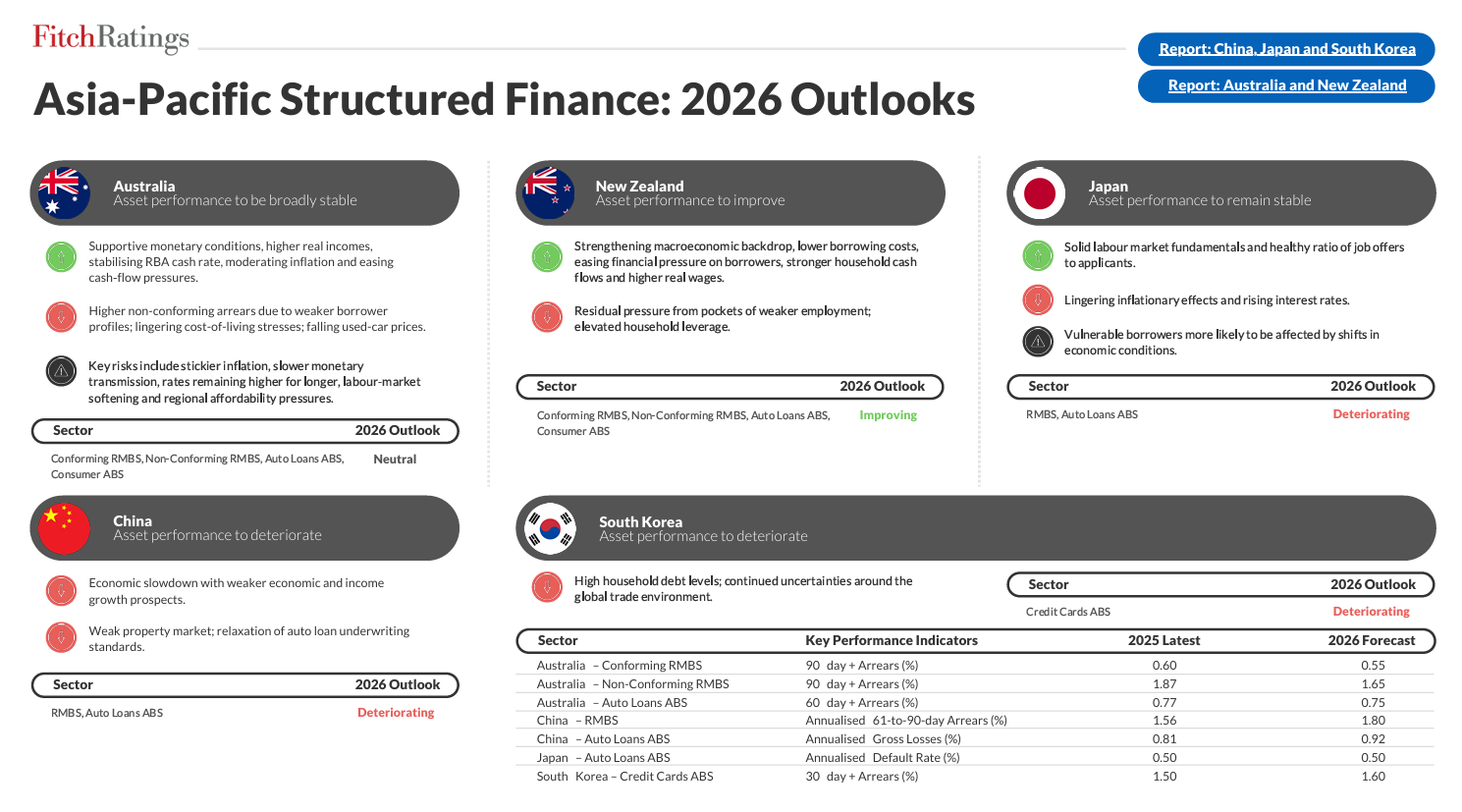

The asset performance of structured finance in Australia, Japan, and New Zealand is expected to remain broadly stable or improve in 2026, whilst China and South Korea will see deterioration, said Fitch Ratings.

Australian structured finances’ asset performance will be broadly stable thanks to supportive monetary conditions, higher real incomes, stabilising RBA cash rate, moderating inflation, and easing cash flow pressures, the ratings agency said.

However, it will face higher non-conforming arrears due to weaker borrower profiles, lingering cost-of-living stresses, and falling used-car prices.

New Zealand’s structured finances’ asset performance is set to improve on a strengthening macroeconomic backdrop, lower borrowing costs, easing financial pressure on borrowers, stronger household cash flows, and higher real wages.

Challenges include residual pressure from pockets of weaker employment and elevated household leverage.

Like Australia, the asset performance in Japan is expected to remain stable on solid labour market fundamentals and healthy ratio of job offers to applicants, Fitch Ratings said. Challenges are lingering inflationary effects and rising interest rates.

In contrast, both China and South Korea’s asset performances are expected to deteriorate in 2026.

Advertise

Advertise