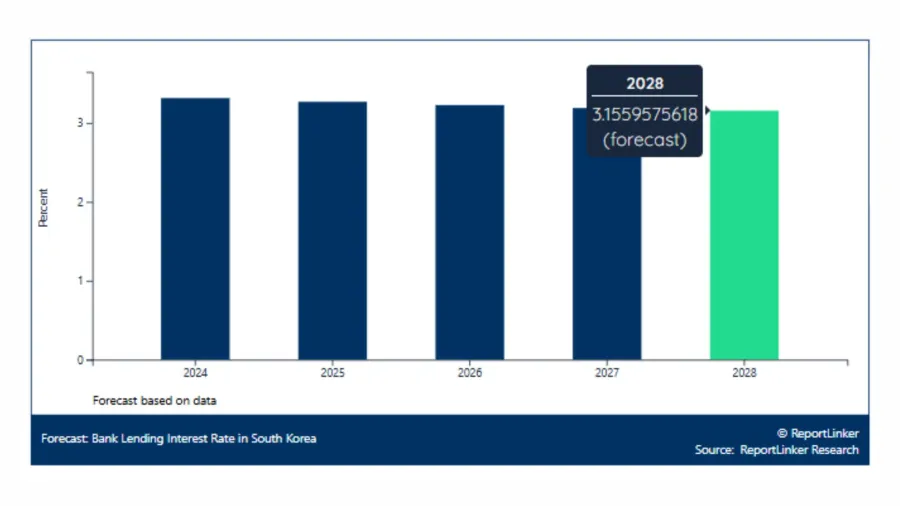

South Korea lending rate to fall to 3.16% by 2028

Borrowing costs will extend their downward trend after a 21% drop in 2023.

South Korea’s bank lending interest rate is slated to slow down to 3.16% by 2028, according to ReportLinker Research.

The country’s bank lending interest rate fell to 3.37% in 2023, down from 4.64% in 2013, according to available data.

The rate has fluctuated over the past decade and reached a recent peak of 4.29% in 2022 before declining the following year.

Year-on-year, the rate dropped by 21.44% from 2022 to 2023 and is estimated to ease by a further 1.48% from 2023 to 2024. Over the past five years, the compound annual growth rate was -0.98%, showing a steady annual decline.

The lending rate is forecast to continue trending lower, reaching about 3.16% by 2028.

Future movements will depend on global economic conditions, regulatory changes, and monetary policy decisions that affect borrowing costs.

Recent data showed that South Korean banks’ delinquency rate on won-denominated loans rose for a second straight month in November 2025, as both corporate and household borrowers recorded more bad loans.

The delinquency rate reached 0.6% at end-November, up 0.02 percentage points from October and 0.08 percentage points higher than a year earlier, according to data released by the Financial Supervisory Service on 28 January 2026.

Despite the higher ratio, the volume of newly delinquent loans fell by KRW0.3tn during the month, whilst resolved loans increased by KRW0.6tn.

By borrower segment, delinquency rates rose across large companies, small and medium-sized enterprises (SMEs), and households.

The rate on loans to large firms edged up to 0.16% from 0.14% a month earlier. SME loans recorded a delinquency rate of 0.89%, whilst household loans rose by 0.02 percentage points to 0.44%.

Separately, bank lending to both households and corporates declined in December, reflecting lower mortgage borrowing in the sector.

Advertise

Advertise