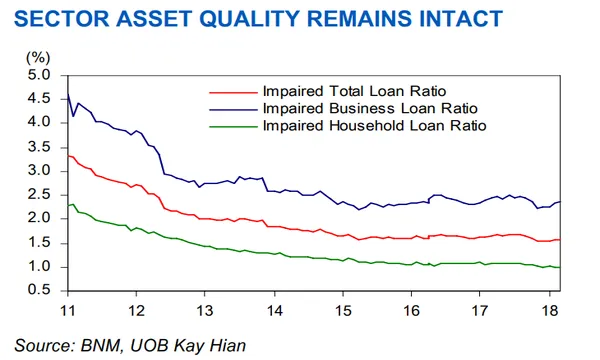

Chart of the Week: Malaysian banks' bad loans down to 1.6% in May

Consumer gross impaired loan ratio has plunged to a historical low of 1%.

Malaysia's banking system has little to fear from bad loans as gross impared loan (GIL) ratio has remained benigh after improving from 1.67% in September to 1.6% in May, according to UOB Kay Hian.

Also read: Here's why the abolition of the goods and services tax is positive for Malaysian banks

Consumer GIL ratio has also stabilised to a historial low of 1% whilst business GIL ratio has remained largely stable amidst an oil prices recovery.

"We expect the strong performance of the Malaysian economy in 2017 and 2018 to keep a lid on impaired loans, which currently only account for a small proportion of 1.5% of total loans as of April," BMI Research said in a separate report.

Also read: Malaysian bank loan growth may hit 7% in 2018

Only non-residential property loans had deteriorating asset quality with the segment's GIL ratio hitting a six-year high from 1.06% in December to 1.32% in May.

"As such, we expect asset quality to remain strong over the coming quarters, which is positive for macroeconomic stability and credit growth," BMI added.

Advertise

Advertise