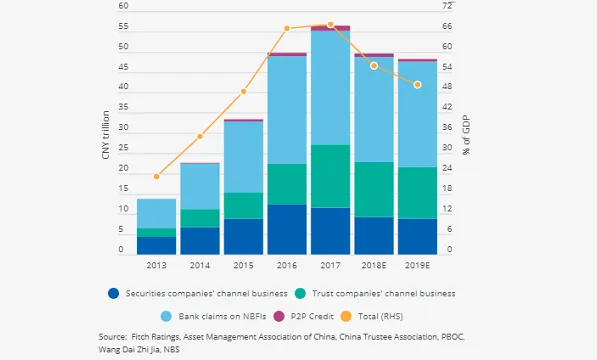

China's shadow banking sector to shrink to half of GDP in 2019

Lenders have been shifting to on-balance sheet activities.

China’s shadow banking assets is expected to contract to around half of nominal GDP by end-2019 from a peak of 70% In 2017 as the country’s regulators intensify crackdown on financial sector risk, according to Fitch Ratings.

Also read: China's shadow banking assets plunged to $393.40b in H1

Leverage outside banks have been rising at a noticeably slower pace and contagion risks between banks and non-bank financial institutions have dropped in tandem with the decline in shadow banking activity. Regulatory scrutiny over P2P lending has also increased significantly.

Also read: China's shadow banking sector shrunk to $9.01t in January-September

“China's shadow financing is likely to decline for a second year consecutive year in 2019, albeit more gradually than in 2018, as the authorities balance reining in excessive leverage and supporting economic growth,” Rowena Chang, associate director for financial institutions said in a report.

Also read: China banks' assets plunge to single digits in 2017 as loans take over

The channel businesses of securities companies and trust companies is also expected to taper off in 2019 as the deleveraging clamps down on risks for asset managers especially those that they incur when charging low fees for passive management. Assets related to the channel business accounted fo 70% of securities and trust companies’ AUM in Q3 2018.

“New measures have, for example, made it much more difficult for asset managers to engage in "channel business", whereby they act as intermediaries channelling bank funds to high-yielding credit-type assets,” said Chang. “The regulatory changes will influence asset managers' business mix, shifting them away from the low-margin channel business and towards wider-margin, actively-managed asset portfolios.”

Banks in China have employed shadow banking set-ups to disguise non-standard lending activities in 2013-2017 and avoid regulatory supervision which led to a sharp rise in leverage. Although the crackdown will support the long-term stability of the financial system, it will continue to create funding challenges for corporate who have relied on shadow finance.

Advertise

Advertise