India’s private banks’ NIMs contract 32 basis points in Oct-Dec 2023

Growth in unsecured loans is expected to slow, which will impact credit growth and NIMs.

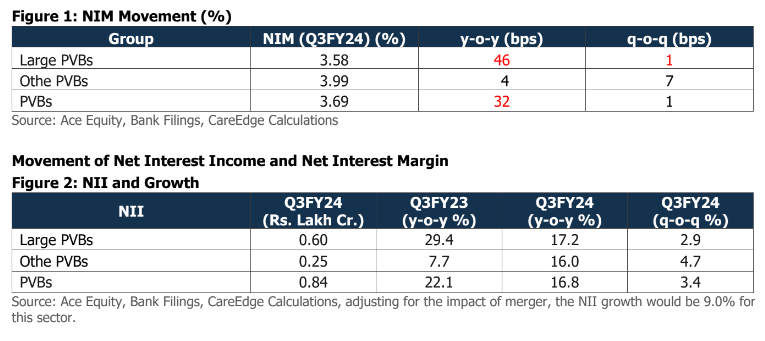

India’s private banks saw their net interest margins (NIM) contract 32 basis points to 3.69% year-on-year in October to December 2023 or the Q3 FY2024 period.

This was blamed by large private sector banks (PVBs) large drop in NIM.

Net interest income (NII) grew by 16.8% year-on-year, however, as a result of health loan growth, the HDFC merger, and a higher yield on advances compared to the same three-month period a year earlier.

The Credit and Deposit (C/D) ratio for PVBs stood at 80.7% as of December 31, 2023, expanding by ~330 bps y-o-y over a year ago due to widening credit-deposit growth and HDFC merger impact.

ALSO READ: Chart of the Week: Indian banks’ credit exposure to NBFCs slows in Dec

The HDFC Bank-HDFC Limited merger, effective from July 2023, absorbed the balance sheet of HDFC Limited which, as a housing finance company, had comparatively lower NIMs given the loan portfolio and moderate liability profile (higher borrowings and less low-cost deposits).

This merger is leading to tighter NIMs, as typically NBFCs operate at lower NIM when compared to a bank and this effect is likely to persist given the size of HDFC’s balance sheet, CareEdge Ratings noted.

“Furthermore, the recent RBI notification to all lenders increased the risk weights by 25% on unsecured consumer credit is a strong signalling impact to deter growth in the unsecured space. Hence growth in unsecured loans which is comparatively a higher- yielding product is likely to slow and consequently impact the credit growth as well as NIMs,” CareEdge Ratings said.

Advertise

Advertise