Chart of the Week: Indian banks’ credit exposure to NBFCs slows in Dec

However, the growth trajectory is still higher compared to a couple of years ago, data showed.

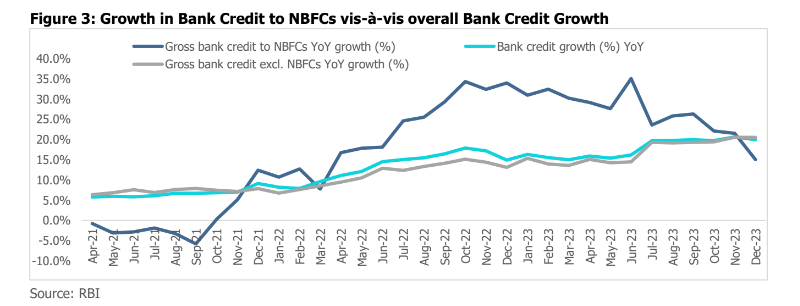

Credit exposure of Indian banks to non-banking financial institutions (NBFCs) grew slower in December 2023, according to data from CareEdge Ratings.

Banks’ credit exposure grew 15.1% during the month, slower than in November. Notably, the growth rate of advances to NBFCs has fallen below the overall bank credit growth, CareEdge said.

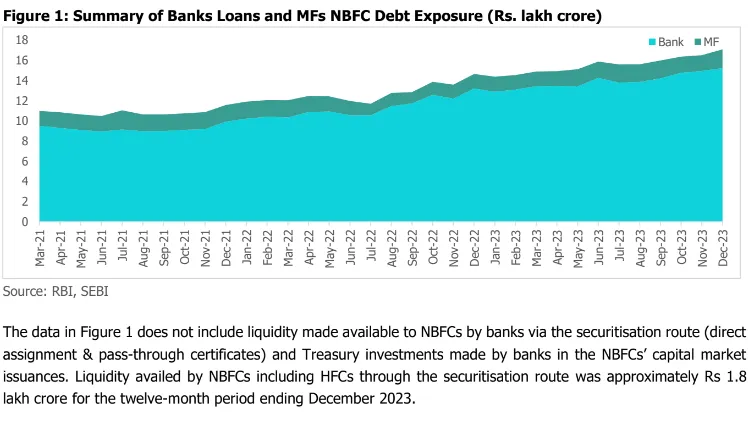

As of December 2023, credit exposure of banks to NBFCs stood at Rs 15.2 lakh crore (approximately US$183b).

Meanwhile, mutual fund (MF) debt exposure to NBFCs rose 30.8% in December compared to the same month in 2022. However, given the general credit risk aversion of MFs, the exposure to NBFCs, particularly those rated below the highest levels, CareEdge does not expecte to witness significant traction.

“Consequently, the aggregate dependence of mid-sized NBFCs on the banking sector for funding is likely to remain high,” CareEdge said in a report.

Although growth came in slower, growth of credit exposure is still higher than a couple of years ago, CareEdge Ratings and central bank data showed.

“The credit extended by banks to NBFCs has exhibited a consistent upward trend for close to six years and continued its acceleration along with the phased reopening of economies after the Covid-19 pandemic. This growth momentum further accelerated during FY2023 and continued in H1 FY2024,” CareEdge Ratings wrote in the report.

The merger of HDFC Limited and HDFC bank reduced outstanding exposure of banks to NBFCs, although growth rate was maintained.

(US$1 = IDR83.06)

Advertise

Advertise