Malaysia’s corporate loans grow faster in Q2

Household loans grew at the same pace as in Q1.

Malaysian banks extended more loans to the private non-financial sector in Q2 2024 thanks to the growth of business loans and corporate bonds, central bank data showed.

Credit growth to the private non-finance sector rose by 5.4% in Q2, according to the Bank Negara Malaysia (BNM). This extends the 5.2% growth in Q1.

Outstanding business loans rose by 5.6% during the quarter, 0.5 percentage points (ppt) higher than the 5.1% growth in Q1.

Outstanding corporate bonds rose by 3.4% growth in Q2, extending the 3.2% growth recorded in Q1.

By sector, the construction and manufacturing sectors recorded stronger growth.

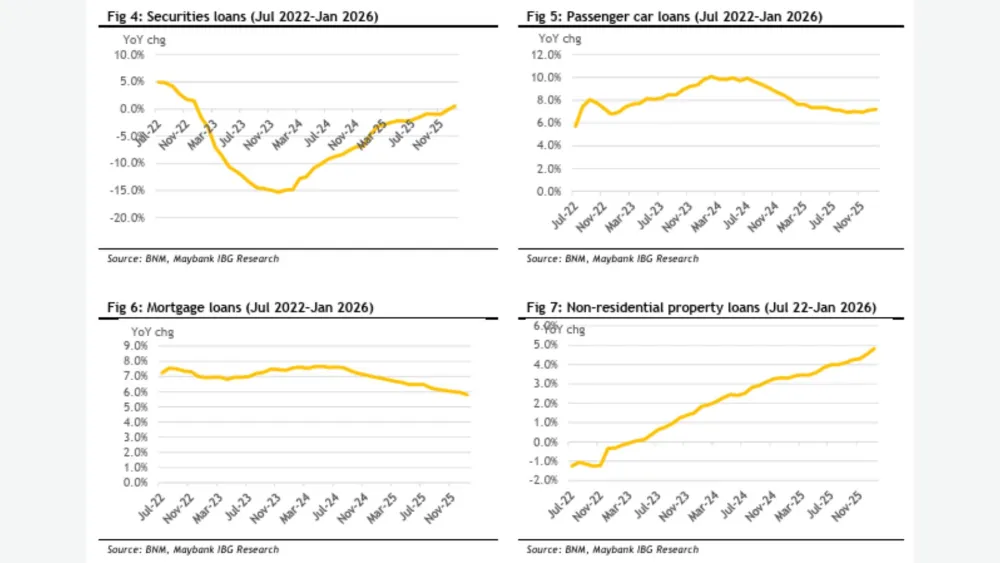

Demand for household loans remained forthcoming, particularly for mortgages, the BNM said.

Advertise

Advertise