South Korean financial firms to tighten lending standards in Q4: survey

The 18 banks polled indicated that they will be pickier on approving loans.

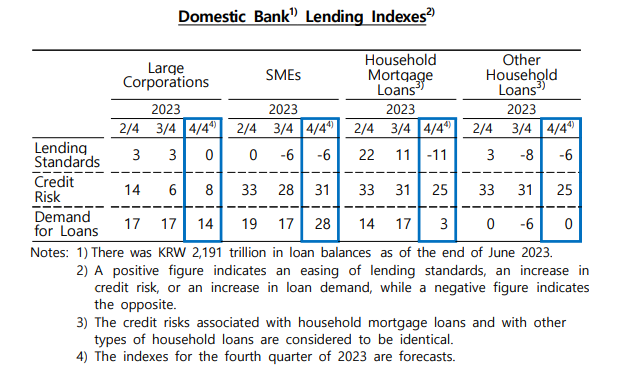

Banks and non-bank financial institutions in South Korea are tightening their lending standards for households and small companies in the last three months of 2023, a recent survey by the Bank of Korea (BOK) showed.

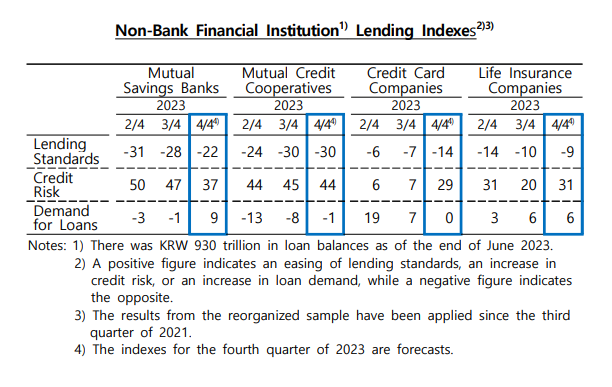

The survey–which polled 18 domestic banks, 26 mutual savings banks (MSBs), 142 mutual credit cooperatives (MCCs), 8 credit card companies, 10 life insurance companies–logged lower and negative figures for Q4.

Banks’ lending standards to SMEs fell to -6 in Q4 from 0 in Q3; whilst household mortgage lending plummeted from a score of 22 in Q3 to -11 in Q4. Other household loans improved slightly but remained at the negative scale, at -6 in Q4.

A negative figure means tightening of lending standards.

ALSO READ: SEA digital payments slated for growth as e-commerce market doubles: study

Lending standards to corporates, meanwhile, will likely remain at the same tangent as in Q3, with a “0” score.

The tightening of standards comes as banks expect demand for mortgages, domestic loans, and loans from small and medium enterprises (SMEs) are expected to rise in the last three months of 2023, according to the poll.

Non-bank financial institutions are even more likely to adopt tighter lending standards than banks, for both corporations and individuals.

The BOK conducted its survey from 30 August to 13 September 2023.

Advertise

Advertise