China

China's NPLs reached a whopping US$79b at the end of 2012

China's NPLs reached a whopping US$79b at the end of 2012

Asset management companies will be set up to fend off risks.

3 things that will weigh on China banks' profits over the next 5 years

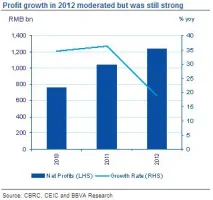

Profit growth will slip to single-digit levels.

China banks' 2012 profit growth down to 19% from a record 39% in the previous year

But results are still impressive, thanks to better NPLs.

China Merchants Bank's net profit up 25% to RMB 45.3bn in 2012

Total loans and deposits also rose 16% and 14%.

Chinese banks demand tougher regulation of non-financial institutions

Ask government to draft rules to head off higher risk.

Chinese banks’ bad loans jumped by 39%

Stood at US$69 billion in 2012.

6 reasons behind China Construction Bank's overweight stock rating

Find out why Barclays prefers CCB.

China's total social financing peaked in January at RMB2.5t: Barclays

Find out what other risks loom for China.

RMB now ranks 13th in the world payments currency list

It has already overtaken the Russian Rouble.

China gets tougher on shadow banking

New rules intend to slow explosive growth of the gray market.

Agricultural Bank of China reports record growth in loans to SMEs

Big Four bank said loans hit US$96 billion in 2012.

China to expand asset-backed securities businesses

Will lower threshold to allow securities companies to do this.

IFC unveils new financial instrument for RMB internationalization

Find out what IFC's Global Discount Note Program is about.

Banks take the lead expanding China, Gulf States ties

Biggest banks in China and the United Arab Emirates key to building closer financial ties.

China and England agree to a reciprocal 3-year RMB currency swap arrangement

The arrangement will be used to finance direct investment between the UK and China.

Bank lending to local government financing vehicles curbed

China urges local governments to abide by the rules to avert more bad loans.

ICBC's profit surged 69% to US$54m in Dubai

Thanks to stronger trade between China and Dubai.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership