China

CMB International and MA Financial to co-manage $600m private credit fund

CMB International and MA Financial to co-manage $600m private credit fund

The fund will focus on senior secured leveraged loans.

1 day ago

Chinese banks slash USD bond exposure to 85%

Banks are increasing bond investments in the Euro and likely the AUD, said BofA.

1 day ago

Chinese banks miss Hong Kong stablecoin opportunities as rules tighten

China is likely to push the e-CNY as it extends stablecoin restrictions to offshore.

2 days ago

Alipay’s agentic-powered AI Pay exceeds 120 million transactions

AI Pay is being used by Luckin Coffee and Rokid, amongst others.

6 days ago

Close gov’t supervision driving Evergrowing Bank risk upgrades

S&P flags legacy loan strain despite Shandong oversight push.

LSEG expands China reach with ICBC deal

The MoU covers RMB services, trading, clearing, and FTSE Russell

UnionPay links 25 foreign wallets to Weixin Pay as China QR use surges

Global travellers can use domestic cards on Weixin Pay QR network

China bank asset quality risks surge on state lending

Relending rates fell by 25 bps to relieve funding pressure on micro and small enterprises.

China Bohai Bank faces high asset risk from retail and investment loans

Its NPL ratio rose 5 basis points in June 2025 compared to six months prior.

CZBANK stays stable but property risks spark new NPL threat

Net interest margin narrowed in 9M 2025, but this is expected to slow, Moody’s said.

CMB seen as top winner in China’s wealth reallocation, CGSI says

CGSI expects the bank to benefit from stronger demand for wealth management and bancassurance products.

Chinese banks defy Vanke contagion as S&P forecasts 4% growth

Weak-loan ratios are currently performing better than the agency had previously anticipated.

HSBC China takes wealth management to new heights

Its wealth centres, comprehensive solutions, and digital tools are at the core of its strategy.

Apple Pay opens China Visa cards as NFC hits 79%

The rollout starts with ICBC BOC ABC BoCom CMB CITIC Ping An and Industrial Bank.

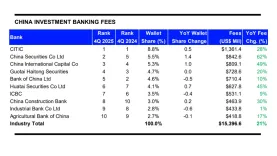

CITIC leads China investment banking fees as market hits 3-year high

It retained its position as the top financial institution in terms of IB fees raised.

China investment banking rebounds to $15.4b fees

Government-backed deals drive $474 billion China M&A boom

PAObank assets more than double, gets $64.2m capital

PAObank chief executive Ronald Iu said the capital injection reflects shareholder support.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership