India

National Payments Corporation of India, Fonepay tie up for cross-border QR-code

National Payments Corporation of India, Fonepay tie up for cross-border QR-code

Both companies have completed operational preparations.

Citi India initiates 12-month WFH set-up after mothers give birth

This comes on top of their paid maternity leaves.

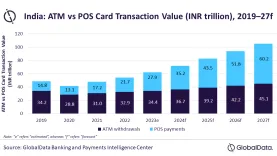

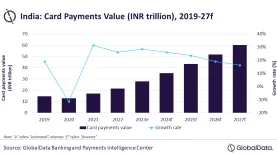

India’s card payments market to rise 28.6% to $337.1b in 2023

Consumers in India are increasingly embracing electronic payments, GlobalData said.

More cryptocurrency users in India by 2027, to surpass US and UK combined

India is expected to account for 33% of one billion global users in four years.

India assures banks it’s ready to manage outflow of Russian funds: report

Russian companies have accumulated billions of rupees in local banks.

India’s card payments to triple in size by 2027: GlobalData

It is expected to triple in size to $728.2b in 2027 from last year’s $262.1b.

Public Bank enhances security measures against scams

This warning goes on the back of a recent social media scam that promoted small-interest loans.

India’s HDFC to offer 2% shares in NSDL IPO

This is equivalent to four million equity shares.

HSBC launches global private banking business in India

It will service clients with investable assets of over $2m.

Indian banks’ bad assets improve to 10-year low: CareEdge

SCB’s recorded a 10-year low of 3.9% for its GNPA.

India's competition entity approves HDFC’s request to increase shareholding in HDFC Life, Ergo

HDFC increased its shareholding in the two entities to more than 50%.

IndusInd Bank, Wise offer remittance services to US, Singapore

Internationally-based Indian citizens can remit from Singapore and the US.

India’s Axis Bank names central bank ex-deputy governor as non-executive chairman

N.S. Vishwanathan will assume the role on 27 October, pending approval.

Citi launches sustainable time deposit for India-based institutional clients

This is the product’s third market, after Singapore and Hong Kong.

Axis Bank names Nurani Subramanian Vishwanathan as independent director

Vishwanathan has had diverse experiences as a central banker since 1981.

Indian banks’ profits to stabilize; weak assets to persist for some

Weak assets are expected to make up 5.2% of gross loans for FY2023.

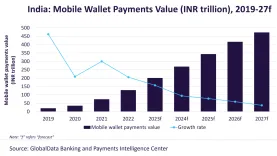

Mobile wallet payments in India to hit $5.7t in 2027

The value of mobile wallet payments doubled from 2018 to 2022.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership