Korea

Here's what makes Korean banks aptly armed against liquidity shocks

Here's what makes Korean banks aptly armed against liquidity shocks

But the improvements could be limited.

Korean banks to dodge woes of earnings impact from Pantech's court filing

They had already provisioned against exposure.

Bank loans in Korea slightly climb 0.5% m-m to KRW1,151tn in July

While large corporate loans remained flat.

Lower credit costs drove Korean banks' profits to KRW3.7 trillion: Moody’s

Policy banks led the higher profits.

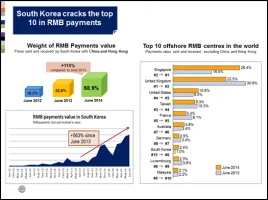

South Korea cracks the top ten in RMB payments

RMB payments surged an impressive 563%.

NIM of Korean banks forecast to jump towards year end

But it's at a modest pace.

Easing Korean mortgage regulation to aggravate high debt ratio: Fitch

Debt-servicing capacities could be maimed.

Korea's commercial banks suffer 29.5% profit drop

Policy banks saw 134.2% profit dive.

Korean banks' profitability predicted to suffer from tepid loan growth

How will it affect lending margins?

Why analysts are not surprised at foreign bank shutdowns in Korea

It reflects only one thing.

South Korea, Russia to establish joint fund to boost investments

Fund announced by Russian President Vladimir Putin. South Korea and Russia agreed this week to establish a US$500 million joint fund with their sovereign wealth funds aimed at increasing cross-border investments in different companies and projects. The deal was announced by Russian President Vladimir Putin who was in South Korea earlier this week on an official visit. Under the agreement, Korea Investment Corporation and the Russian Direct Investment Fund will invest the same amount of money into companies or projects in both nations and invite private sector participation to boost the capital for joint projects. This move is expected to result in a positive return of investment and predictable cash flow. RDIF CEO Kirill Dmitriev said both sovereign funds are currently evaluating a number of joint projects in areas such as infrastructure and energy. He said that with the support of state-backed funds, Korean and Russian companies will feel comfortable when making investments. KIC had some US$64.5 billion in net assets in September while RDIF has US$10 billion in its fund. RDIF was established two years ago to make equity investments, mostly within Russia.

Korean government investigating Big Four financial groups

Probe focusing on allegations of business irregularities. The Financial Supervisory Service is undertaking a simultaneous and extraordinary probe of Hana Financial, KB Financial, Shinhan Financial and Woori Financial. Media reports said the main targets of the regulators include former Hana Financial Group chairman Kim Seung-yu and former KB Financial Group chairman Euh Yoon-dae. Kim is suspected of purchasing thousands of art pieces for irregular purposes during his term as group chief and receiving US$3.2 million in incentives from the financial group when he left his post. Hana Financial has denied the allegations. Kim has also been accused of irregularities during his involvement in the group's takeover of Korea Exchange Bank. KB Kookmin Bank, the flagship unit of KB Financial, is being investigated for an alleged slush fund scandal. The bank’s Tokyo branch allegedly has secret funds for the bank's management. Sources said FSS has uncovered traces of evidence the Tokyo branch manager pocketed large sums of fees while approving off the books loans. FSS discovered that a portion of the commissions, allegedly worth over US$1.87 million, might have been transferred to a domestic account. Investigations seek to determine whether the money was sent to the bank’s management. Shinhan Bank has been under investigation over allegations it might have illicitly accessed lawmakers' bank accounts and private information. Woori Bank allegedly conducted sales of financial products without fully explaining the risks to consumers.

Mobile banking use in Korea rises 1.8% in Q3

This due to strong popularity of smartphones.

Profit pressure looms for Korean credit card firms: analyst

What could have caused this?

Western financial firms fleeing South Korea

It's been going on since 2008.

Global financing institutions to receive more Korean investments in 2014

South Korea raising stature in the international community.

NPLs become a booming business for Korean banks

Generates annual return rate of up to 10%.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership