Malaysia

Malaysian bank and GHL collab to offer interest-free plan

It will be made available to more than 7,000 merchant terminals.

Malaysia's private sector credit grows 5.4% in April

Thanks to higher growth in both outstanding loans and corporate bonds.

GHL and BSN partner to expand in-store payment choices

Shoppers at GHL stores can now enjoy up to 36 months of BSN's 0% EasyPay.

Hong Leong Bank posts 7.1% profit growth in 9MFY24

This translated to a profit of $671m.

CIMB’s Q1 profit escalates 18% YoY

Thanks to a solid operating income performance and maintained costs.

Maybank sets new crude palm oil, power emissions targets by 2030

In 2023, CPO production and power emissions are well below reference scenarios.

Kenanga Investment Bank’s net profit doubles to RM26.7m in Q1

But the stockbroking and investment banking divisions reported losses before tax.

Maybank’s net income up 9.8% to RM2.49b in Q1

Non-interest income jumped 79.2% and lifted operating income for the quarter.

Public Bank’s net profits down 3.5% to $351.94m in Q1

Total loans and deposits grew in Q1 compared to Q4 2023.

Malaysia, South Korea renew their bilateral swap agreement

The swap arrangement can be further extended via mutual agreement.

CIMB Group’s opex to ease whilst non-interest income poised for growth

Loans are poised for a 6% growth, UOB Kay Hian said in a report.

CIMB Thai’s de-risking and cost optimisation pays off

Moody’s Ratings says its asset quality, profitability and liquidity is “modest”.

GX Bank, Zurich Malaysia ink 10-year bancassurance partnership

They will co-create micro digital insurance products for Malaysians.

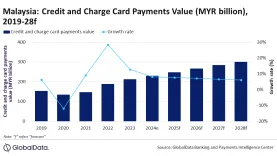

Malaysia’s credit, charge card market value grows to $50.5b in 2024

Credit and charge cards make up 60% of all card payments in the country.

Malaysian banks’ asset quality strong but profits to stay flat in 2024

A sustained currency depreciation may affect import-reliant sectors, an analyst warned.

Malaysia warns against four unauthorised companies

They have similar names to companies authorised by BNM but are not related to them.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership