Singapore

APAC banks to launch cross-border real-time payments via SWIFT gpi

APAC banks to launch cross-border real-time payments via SWIFT gpi

DBS, ANZ, Kasikornbank, and ICBC are amongst the participants.

MAS tightening to bolster Singapore banks' performance

Banks are set to benefit from rising loans which grew 10%, as well as higher SGD and USD interest rates.

Which APAC banks need to brace for IFRS 9 impact?

Find out which banks may face difficulty amidst a lack of long-run historical data.

The biggest challenges Southeast Asian banks are facing today

Banking executives today not only have to deal with running the bank, but also transforming it to grow in a sustainable manner. Banks have to balance these goals against the exigencies of the day, and those that are able to do so will be amply rewarded. This holds true for all banks, even those operating in Southeast Asia (SEA).

The evolving digitalisation of wealth management

With the constantly changing technology and client behaviour, the WM sector must digitally keep up.

OCBC expands AI voice banking services with Google

Customers can now inquire about OCBC’s services through a Google Assistant.

APAC's bancassurers turn to blockchain to enhance offerings

CCB and AIA collaborated to offer blockchain-powered bancassurance products.

Weekly Global News Wrap Up: Blockchain may hammer Swiss banks; US banks can cash in on higher Libor

And it's the start of a good year for BofA as profits rose 34% in Q1.

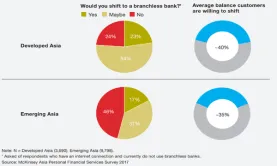

Chart of the Week: How open is Asia to branchless banks?

Approximately 55-80% of customers are considering opening an account in a digital-only bank.

Asia beats Europe in developing new payments technologies

The region has attracted more fintech investments than North America and Europe.

Nearly 8 in 10 Singaporeans open to branchless banking

It helps that digital banking penetration in the lion city is high at 97%. Nearly 8 in 10 banking customers in Singapore admitted that they would consider opening an account with a branchless, digital-only banks, according to a report from management consultancy firm McKinsey. Of this number, Singaporeans are willing to migrate more than a third or approximately 35% of the assets in their accounts to a digital wallet.

Smartphone banking booms in Asia as digital penetration expands threefold

Mobile banking has grown at least twofold in Emerging Asia to outpace other e-banking types. Smartphone banking is on the rise in Asia as it has outpaced all other e-banking types with digital penetration expanding in both scope and scale particularly in Emerging Asian markets, according to a report from management consultancy firm McKinsey. Digital banking penetration has expanded from 1.5 times to as much as threefold in various Emerging Asian economies since 2014, giving rise to a larger percentage of digitally active customers, accounting for a fourth (25%) of the population in markets like China, India, Indonesia, Korea, Malaysia, Pakistan, Philippines, Taiwan, and Thailand and 85% of the population in Developed Asia. The median for e-banking penetration is at almost thorough at 97 for Developed Asia and more than half at 52 for Emerging Asia. “For banks, these changes represent both a challenge and an opportunity,” said McKinsey & Company partner and head of Asia Pacific digital banking practice Vinayak HV. “What’s clear is that they cannot rely on their existing business models and need to consciously invest to change their businesses in line with rapid changes in consumer sentiment and behaviour.” Major banking players need to fine-tune their digital strategies in an effort to tap the increasingly online audience or risk losing patronage to mobile wallets who are quickly snapping up market share in India and Hong Kong.

Singapore banks' bad loans are on the rise

Aggregate NPL ratio of local banking groups rose from 0.4% to 1.6% in 2017.

Citi Asia Pacific's profits soars 48% to $1.24b in Q1

It accounted for more than a fourth (26%) of the group’s global profits.

OCBC debuts quick credit card approval and Apple Pay integration

Customers can make purchases at Apple Pay merchants within minutes of credit application.

ICBC Singapore unveils investment banking services

Property owners and developers are the initial target clientele.

UOB forms joint venture with credit scorer Pintec

The joint venture will have a capital of up to $10m.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership