Singapore

DBS transforms bank platform with cloud technology

DBS transforms bank platform with cloud technology

Next-gen credit risk management system is in the works.

Beyond Apple Pay: Which new digital wallets are gaining ground in Asia?

Find out from Standard Chartered, OCBC, EY, Krungsri, and TEB.

Top 3 threats that could cripple Asia Pacific banks' ROEs by 2018

Weakening balance sheets is one.

Weekly Global News Wrap Up: Standard Chartered, HSBC cut credit card products; Citigroup, AT&T end court battle; Banks mull over storing cash in vaults

And boutique banks nabs $100m away from Wall Street rivals.

Chart of the Week: See which Singapore bank is most exposed to O&G

This bank has 7% of loans for the sector.

Are more Asian banks daring to embrace cloud migrations?

DBS plans to migrate half of its workload by 2018 - will other banks follow suit?

Here’s why the risky oil and gas sector is the least of Singapore banks’ headaches

Another sector is the banks’ biggest pressure point.

Diebold completes acquisition of Wincor Nixdorf

Diebold Nixdorf began operations on 16 August.

Standard Chartered Bank launches fingerprint and voice biometric technologies across Asia, Africa and the Middle East

It's already live in Singapore, the UAE and India.

Weekly Global News Wrap Up: JPMorgan Chase builds more branches; HSBC, BofAML use blockchain in trade finance; RBS to move main office

Find out what happened in the global banking scene this week.

Stronger local currency squeezes Singapore banks' NIMs in 2Q16

Average net interest margin was at 1.74%.

UOB is the sore loser in Singapore banks’ bad loans tally

O&G troubles pulled non-performing loan ratio to new highs.

DBS’ net profit slips 6% to $1.05b

The Group’s bad debt rose to $150 million.

Here’s why Singapore banks face plummeting asset quality amidst Swiber fiasco

DBS’ earnings are expected to take a 3.1% hit.

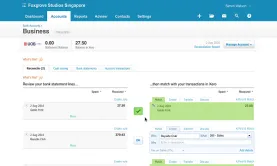

Find out how UOB's BizSmart lets SMEs cut costs by 60% and save time by 40%

SMEs can have a direct feed from their operating accounts with UOB.

Plummeting oil prices slam Singapore banks with stressed assets

OCBC’s nonperforming assets surged 91% in Q2.

Singapore banks’ lacklustre results reveal glaring weakness in asset quality: Moody’s

Non-performing loans are at a disappointing uptrend.

Advertise

Advertise

Commentary

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership

The future of Asian banking isn’t ‘AI-first’ – it’s ‘fearless-first’