Singapore

Who's winning in ASEAN's cashless race?

Who's winning in ASEAN's cashless race?

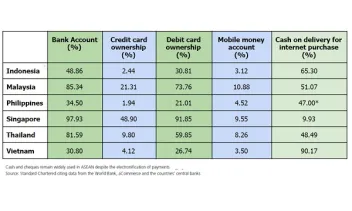

According to Standard Chartered, cash and cheques still reign supreme although evolving customer expectations are prompting incumbents to rethink of more efficient ways to handle transactions.

Singapore crowned as APAC's fintech leader

In APAC, only Singapore and Indian cities made it into the global top ten.

Grab launches Asia's first numberless card

It offers better card security an expanded rewards system.

Tougher times ahead for APAC banks as their risk appetite grows

Conditions make it hard for banks to boost earnings without taking more risk.

EPAA signs MOU to promote financial marketplace platform

It enables financial institutions and fintechs to interact and collaborate at a lower cost.

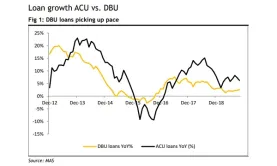

Chart of the Week: Singapore domestic loans up 2.6% in October

This is its fastest expansion since February 2019.

Liquid, Asia United Bank launch cross-border QR payments service

This will enable cross-border transactions between Singapore and the Philippines.

Tribe raises $21.5m to boost market-ready blockchain tech

The firm is focused on expanding its technology and applications by 2020.

Singapore, Japan central banks extend bilateral currency swap program

Under the agreement, Singapore provides yen liquidity to eligible financial firms to support cross-border operations.

Profit headwinds push banks to increase risk appetite

Asset quality metrics in APAC banks do not reflect the risks, Fitch noted.

Asset headwinds spell trouble for Singapore banks

OCBC and UOB have both flagged downgrades in some of their corporate accounts.

Fintech firm Thunes clinches Singapore payments licence

With the new licence, it can now facilitate transactions in its digital membership network.

Deteriorating credit conditions to drag on Bangladeshi banks

Systemwide non-performing loan ratio surged 10 11.7% last 30 June.

OCBC and Standard Chartered completes Singapore's first OIS trade using SORA

The trade is a one-year interest rate swap fixed against SORA.

Fintech startup GoBear's two co-founders to step down

This follows the resignation of former CEO Andre Hesselink in 2018.

China's Ant Financial eyes virtual banking licence in Singapore

It has not disclosed if it will seek a retail or wholesale licence.

Advertise

Advertise

Commentary

Fighting fraud in the digital banking age

Asian banking’s next frontier: Beyond growth, embracing precision

Rethinking cybersecurity: How APAC banks can safeguard against AI-powered threats

Why Singapore’s fast payments need faster protections