Which Singapore bank enjoys the highest corporate customer satisfaction?

A homegrown bank pulled ahead of global rivals like Standard Chartered.

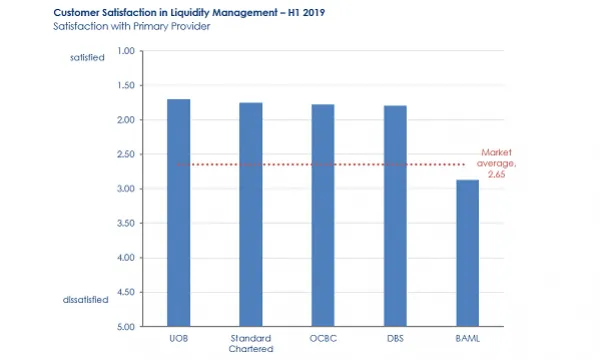

Banks in Singapore enjoy high customer satisfaction rates from their corporate clients, according to bi-annual research from East and Partners, with corporate treasurers hailing UOB as the regional leader for liquidity management solutions.

With a score of 1.70 with one being the most satisfied and five being the most dissatisfied, the Wee-owned bank pulled ahead of global lenders like Standard Chartered (1.75) which ranks second and Bank of America Merrill Lynch which occupies fifth spot. Homegrown lenders OCBC occupy third place with an index score of 1.78, followed by DBS at 1.80.

Also read: Singaporeans ditch bank visits to go mobile

In terms of short-term debt, OCBC leads the pack with a customer satisfaction level of 1.53, followed by UOB, Bank of China, CIMB and DBS.

In terms of service metrics, the Singapore banks are also winning marks in critical factors, including value for money and credit approval turnaround times.

“This actually plays into the Singapore banks’ advantage as the big international banks start to refine and rationalise their relationships with corporate clients,” said Sangiita Yoong, East and Partners Asia business head. “The key issue now is how to turn these happy customers into advocates and subsequently ensuring a strong presence in the customer’s mind. In short, linking customer satisfaction with advocacy and wallet growth."

The bi-annual research looks at demand for transaction banking products and relationships from the top 1,000 institutions across ten major markets in Asia, including China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand and based on direct interviews with 942 chief financial officers (CFOs) and corporate treasurers.

Advertise

Advertise