South Korea

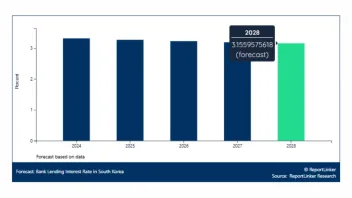

South Korea lending rate to fall to 3.16% by 2028

South Korea lending rate to fall to 3.16% by 2028

Borrowing costs will extend their downward trend after a 21% drop in 2023.

3 days ago

Korean regulators hit 5 banks with record $1.38b in ELS penalties

Kookmin Bank will face the highest penalty if based on sales amount, the report said.

Korea revises bill to check criminal info of virtual asset service providers

The law also broadened rule-breaking activities that are screened.

Standard Chartered names Ryan Song as head of M&A in Korea

He is expected to help grow the bank’s M&A advisory business in the region.

South Korea regulator widens responsibilities maps from insurers to savings banks

FSC invites $0.49b savings banks into pilot ahead of 2 July 2026.

South Korean bank delinquencies hit 0.6% with SMEs hit hardest

Volume of newly delinquent loans shrank whilst resolved loans rose.

Korea’s outstanding deposit rate fell in December whilst loan rates climbed

Rates for new deposits rose during the month.

South Korea rewrites bank loan-deposit rules to push regional lending

Regulators plan to upgrade rules and provide incentives to improve regional banks’ competitiveness.

Airwallex buys Paynuri to enter South Korea payments market

It plans to hire 20 employees in the market in 2026.

Korean banks’ loans contracted in December as banks guarded capital ratios

SME loans fell as banks slowed down lending for their capital adequacy ratios.

Alipay+ sees tourist spending rise on foreign e-wallet use

Beauty clinic transactions and transportation transactions rose during the year.

Citi names Soonwok Kwon as head of market sales for South Korea

Kwon used to work at UBS AG and Credit Suisse AG in Seoul.

Visa, DealMe launch instant installment option for Vietnamese cardholders

Pilot merchants include Shinsegae Duty Free and select clinics in South Korea.

Alipay+ enables overseas tap-to-pay service for Kakao Pay users

Kakao Pay users can now make NFC payments at Mastercard merchants worldwide.

PayPay expands reach to 2 million South Korea stores via Alipay+ gateway

Users must complete identity verification on the PayPay app in Japan.

South Korea’s home mortgage loan growth inch up in August

Resumption of non-face-to-face lending brings back household loans to a growth.

South Korean depository corporations raise industrial lending by 2.7% in Q2

Lending for working capital and facilities investment rose during the quarter.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership