Thailand

KBank to eliminate long-term loan for coal power by 2030

KBank to eliminate long-term loan for coal power by 2030

KBank is a signatory of the UN's sustainable financing initiative.

Siam Commercial Bank’s restructuring highlights Thai banks’ need for complexity: analysts

The new entity aims to become a regional fintech conglomerate by 2025.

Relaxed regulation heightens Thailand banks’ systematic risks: S&P

NPL ratio is expected to rise to its highest since the 2009 financial crisis.

New bank players from Thai, Malaysia agreement face limited growth prospects

The latest licensed banks in Thailand have loan market share below 0.5%.

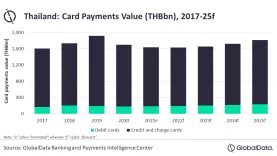

Chart of the Week: Thai card payments market to shrink 3.5% in 2021

Recovery is not expected to begin until end-2022, says GlobalData.

Bank of Thailand base rate to hold through 2022: Fitch

This comes at the back of a bleak economic outlook due to the recent COVID-19 outbreak.

SEA banks’ asset quality visibility still cloudy amidst extended loan relief schemes

Non-performing loan ratios will likely peak only by end-2021 or 2022, when relief measures expire.

Thailand’s KBank unveils sustainability fund for institutional clients

K-SUSTAIN-UI will invest in a sustainability-focused fund managed by JP Morgan.

Thai payment service provider GB Prime Pay now accepts JCB

The partnership expands the online merchant payment network in Thailand.

Strong IPO turnout buoys Thailand's investment banks in 2020

Market rebounded in H2 2020 and raised higher capital compared to 2019.

KASIKORNBANK arranges first credit facility using new Thai Overnight Repurchase Rate

Holding company Central Group received more than $20m under the credit facility.

Thailand IPO boom to buoy Siam Commercial Bank's bottom line

The country is Asia's second most active IPO market in 2020.

No ‘one-size-fits-all' for mobile bank TMRW

UOB’s mobile-only bank makes use of personalization to attract Thailand, Indonesia’s tech-savvy generation.

Thailand's KBank, Central JD Fintech launch one-stop digital loan app

They expect around 100,000 loan applications to be approved by 2021.

KASIKORNBANK's senior VP for retail business joins speakers for the ABF Retail Banking Virtual Conference

Supaneewan Chutrakul is the First Senior Vice President for the Retail Business Division at KASIKORNBANK. She is in charge of supervising KBank’s Retail Innovative Business Solution Department to actively develop a new digital financial platform to serve customers' lifestyle together with the key strategic partners such as Facebook, JD Central, Grab, LINE Finance, Chulalongkorn University, PTT, amongst others.

New measures spur Thai financial institutions to restructure debts

It will cut the amount of reserved provisions, but lower future interest income.

Digital-savvy Thais push banks' fintech adoption: S&P

About 60% of the population are more attuned to digital services.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership